A Second Mortgage: Should You Take It Out?

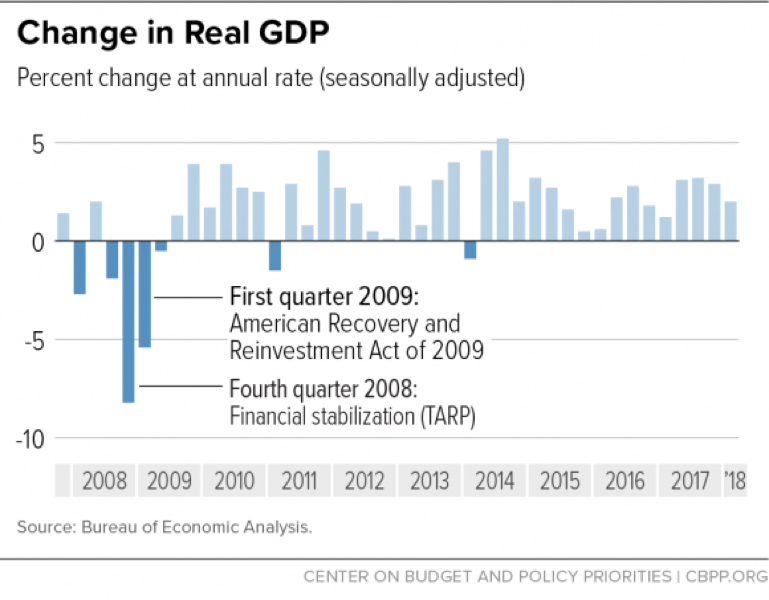

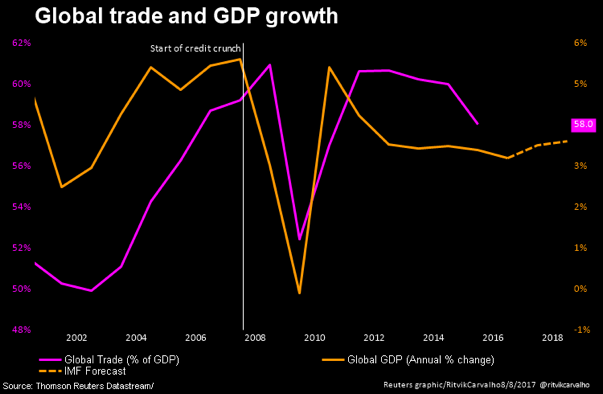

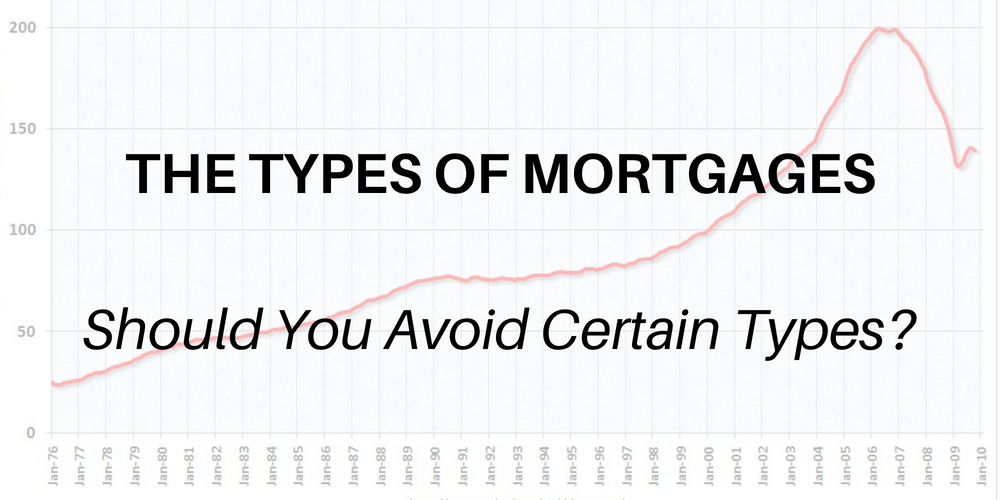

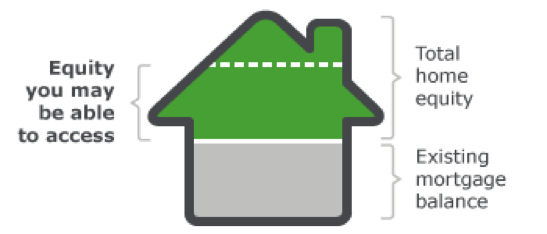

https://www.c4dcrew.com/wp-content/uploads/2018/07/CONTRACT-FOR-DEED_-PROS-AND-CONS-32.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gWe know from the economic meltdown that began in 2008 that using your house as an ATM may not be the best idea. A fat line of credit that can be accessed with a debit card or even checks can be quite tempting, but that doesn’t mean that you should automatically think about taking out a second mortgage loan to tap your equity—unless you have a good reason.

Taking Out a Second Mortgage: Not So Good Reasons

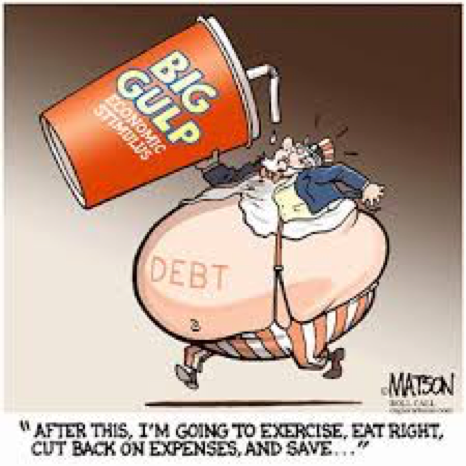

You should only borrow money if you need it. That may sound simple, but in some countries, people borrow money simply because they can. Even in the U.S. in the early 2000s, many people based their “wealth” upon the amount of money they could borrow. Some people with only $5000 in savings but with $100,000 of available credit thought they were well off because they had the ability to raise a substantial sum. Therefore, they acted upon any chance to borrow money and loaded up on credit lines. If you are borrowing money only because you can, that’s not a good reason.

Taking Out a Second Mortgage: Finances are Tight

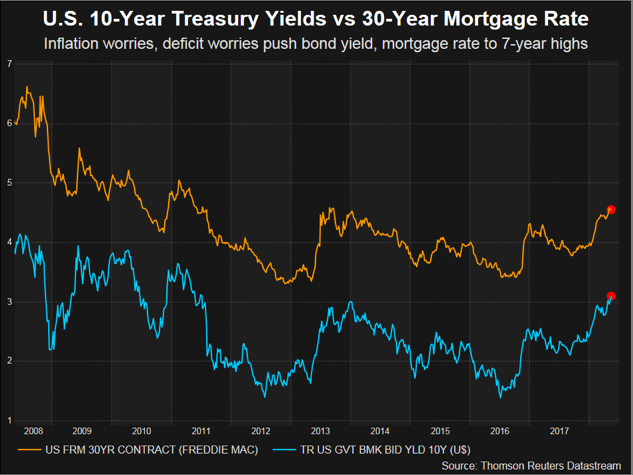

This happens for a reason. If you spend more than you make, you will be cash-flow negative, and that will cause you to borrow. If you have amassed considerable credit card debt, it may be very tempting to take out a second mortgage at a lower combined interest rate and pay off those cards. Seven or eight percent is a lot better than 27.9 percent, but if you don’t cut up your cards after you have paid them off, you may not be able to resist the temptation to max them out again.

You Just Need Some Breathing Room

Breathing room is great, but if the forces that are suffocating you are not dealt with, you won’t make any progress. If your $800 monthly utility bill is killing you, turn down heat, turn up the A/C, quit watering your lawn or turn out the lights. If you don’t act, you’ll soon see another $800 energy bill, and you’ll have to figure out how to pay that. Borrowing against your home for monthly expenses that you can’t reduce is not a good idea. Instead of this, start looking for the best side hustles that allow for some extra income!

Some Better Reasons for Taking Out a Second Mortgage

There are, however, some good reasons to borrow against your home:

- You’re starting a business.

- You want to go back to school and can’t get reasonable student aid or loans.

- You want to help a family member.

- You want to start a remodeling project that will increase your home’s value.

- You want to assist your children with some expenses.

- You found a great investment opportunity.

Like any other loan, make sure you shop around to get the best terms.

The Contract for Deed Crew

While we don’t do second mortgage loans, we at C4D can assist you with the purchase of your home. We are more flexible and understanding than a lot of banks, and we are experts at using the MN contract for deed as a path for true home ownership. If you have any questions, visit our site. We are here to help!