Buy in 2019? 7 Must-Do’s Before Homeownership

https://www.c4dcrew.com/wp-content/uploads/2019/01/CONTRACT-FOR-DEED_-PROS-AND-CONS-34.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gBuying your first home can be an exhilarating but exhausting experience. Before you even worry about the ins and outs of finding a great plumber, you not only have to find the place you want, but you must get your financial life in order in a hurry if you haven’t done that already. Here are seven important things to do before you purchase your first home:

Get A Realtor to Represent You

Important technical point #1: Sellers pay all real estate commissions, including those of a buyer’s agent. You should find the best and most knowledgeable real estate professional in your area and sign them up to represent you. They will flood your inbox with listings, they will help you negotiate, and they will draft purchase offers. And you won’t have to pay a penny, so there is no reason to purchase a home without the help of a buyer’s agent.

Look at Your Budget

Understand what you can afford and what you can’t. Principal and interest aren’t the only components of a monthly payment. You have to add real estate taxes, property insurance and maybe even private mortgage insurance (PMI) to the equation. You can’t start the process of buying your first home without understanding exactly where to draw the affordability line as there is no sense in wasting time looking at properties you can’t afford.

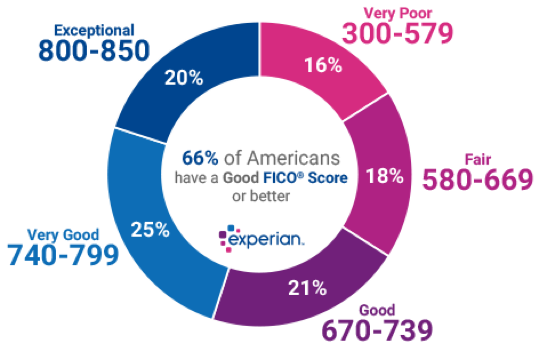

Buying Your First Home: Get Your Credit Score

A few years ago, you had to pay for your credit score, but not anymore. Today, there are many vendors and credit card companies that will provide your score in seconds. If you have a low score, research what you can do to improve it, as your credit score is the first thing lenders look at.

Seek Pre-approval

While pre-approval from a lender does not necessarily guarantee that you will get a loan, it does give sellers assurance that you are creditworthy. When a seller accepts your offer, they are tying up their property until the deal closes, and if you are not a good risk, sellers will look at other offers.

Gather Your Down Payment Resources

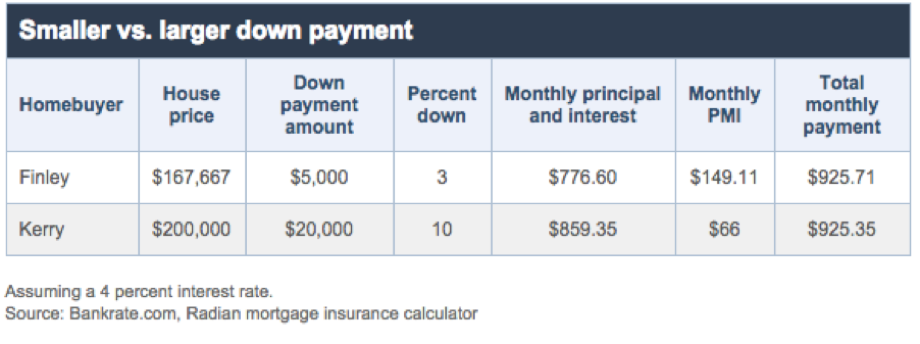

Substantial down payments can work magic because:

- They lower your monthly payment amount.

- They show the lender you are committed and serious.

- They show the seller that you have resources.

Yes, you can but a home with no down payment—a VA loan is one example—but your financing options may be limited, and your interest rate could be higher.

Don’t Fear the Inspection

When buying your first home, you will want to have the property inspected by an impartial third party after your offer is accepted. Many persons worry that the inspector will find something bad and the deal will die. Some deals need to be killed, however, especially if an inspector finds glaring defects and problems. Your dream home can quickly become your nightmare if you don’t have it properly inspected while you still can void your purchase contract.

Have a Contingency Plan

If a deal falls through, or if you are turned down for a mortgage, it’s not the end of the world. There are other homes out there and other financing methods available. MN contract for deed is a great way for those with some credit issues to participate in home ownership. Be sure to contact us if you need an alternative to traditional financing.