How To Invest In Real Estate With Only $1,000 (Yes, You Can!)

https://www.c4dcrew.com/wp-content/uploads/2019/08/CONTRACT-FOR-DEED_-PROS-AND-CONS-20.png 1000 500 Taylor Witt Taylor Witt https://secure.gravatar.com/avatar/c007419611804209e46af7a884e93ad9?s=96&d=mm&r=gThere are numerous articles available online that try and explain to you how to get started in real estate investing. You may think that a real estate investment is not possible with only $1000, but the stock market and the Internet have opened up many avenues that will allow you to become a real estate investor.

Before we get into how to invest in real estate as a hands-on investor, let’s first talk about some more passive options. If at any point the terminology doesn’t make sense, please refer to our handy real estate investing terminology guide.

Stocks

If you take $1,000 and buy approximately 35 share of KB Home stock, you’ll be a real estate investor.

If the stock goes up 10 points you’ll make $350. The stock also pays a yearly dividend of 1.28 percent, so you could pick up a little cash that way also.

REIT ETF

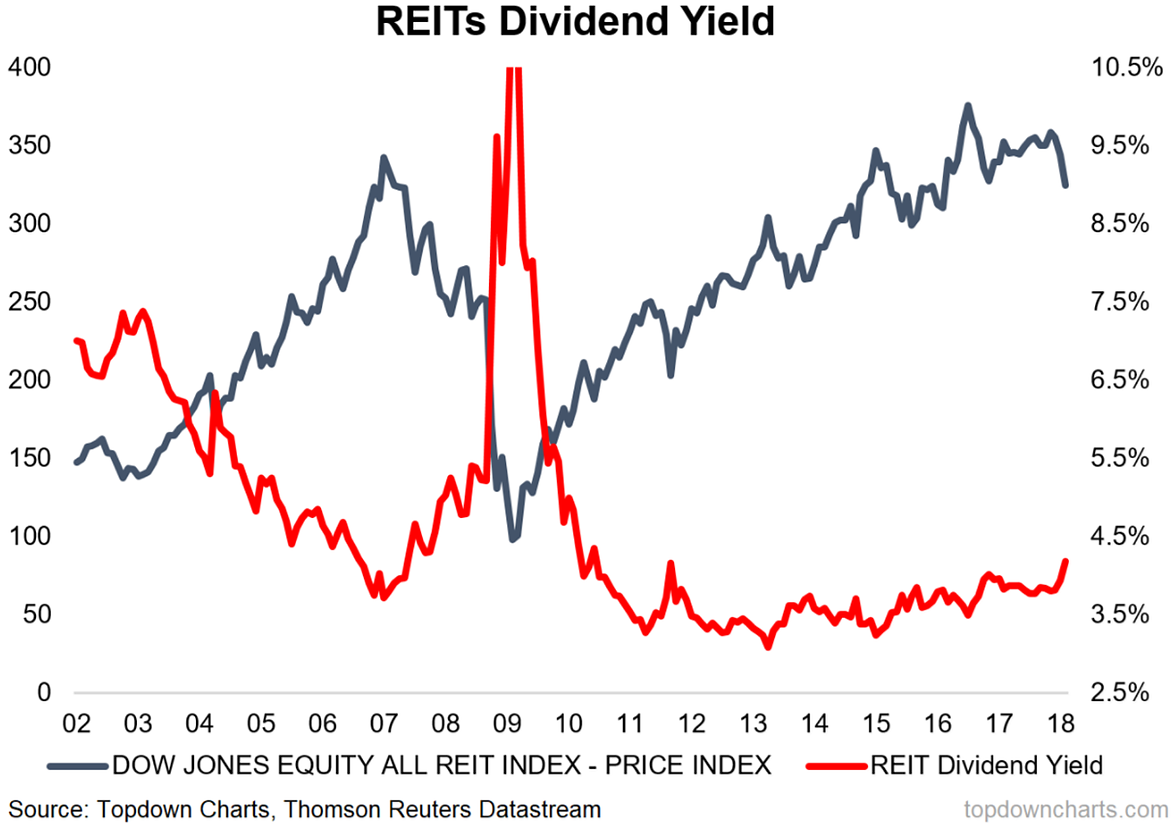

A REIT is a real estate investment trust.

When you purchase an interest in one of these, you trust others to take your money and profitably invest it in real estate projects. If you want to diversify with the world of REITs, you can buy a bester REIT ETF. Eric Rosenberg explains REIT ETFs this way:

“Real estate investment trusts, or REITs, are a great way to invest in real estate for a variety of reasons. They give shareholders a slice of ownership in a property or portfolio of properties and guarantee a certain percentage of the profit gets paid out in dividends. A REIT ETF is a type of fund made up exclusively of REIT stocks.”

If you want to invest in real estate but can’t afford to invest in properties directly or build a diverse portfolio of REITs, a REIT ETF may be the right starting point for you.

With REIT ETFs, you can invest in a diverse range of properties with one low-cost investment — ETFs can be bought and sold like shares of stock on the stock market, and just like stocks, the companies that create and manage ETFs have to provide information to the public that helps you decide if it is a good investment.”

Crowdfunding

Investing in some real estate projects used to be reserved for those persons that were designated as “accredited investors” by the Securities and Exchange Commission.

Basically, if you weren’t wealthy enough to absorb a big private investment loss, you were prohibited from joining the party.

With crowdfunding, you can invest in real estate projects through various sites just by going online line and searching for real estate crowdfunding opportunities. If the project you invest in makes money, you’ll get a share.

How to Get Started in Real Estate Investing Traditionally

Listed above are the passive ways to invest $1000 and become a real estate investor.

If you really want to know how to get started in real estate investing with $1,000, and you desire to get in as an active investor, try these methods:

- Find investors that buy real estate for cash. These people look for motivated sellers and try to find lowball deals. If they can buy under market, the possibility of nice profits exists. See if you can take your $1000 and buy into one of these deals. Also, see if by adding sweat equity–where you would do actual work—you could be offered a bigger chunk of the deal.

- Find a home that you can buy for $1000 down or less and then rent it. This might be a distressed property in a less than desirable area, but if you buy correctly and the area supports the rent you need to generate cash, you could have monthly profits.

- Locate investors that are looking for homes and offer to find good deals in exchange for equity. Use your $1000 to buy signs or to buy some advertising that says you represent an investor that is looking for property. Or, use part of your money to set up a website. Note: be careful not to violate any real estate laws that require a broker’s license to conduct this type of business.

- Buy property in distressed situations. If people have delinquent property taxes or are faced with foreclosure, you can find good deals. If you are going to do all of the work that goes into finding a property, repairing it and then selling it, an investor may cut you in for a nice sized piece of ultimate deal.

Yes, $1000 is enough to get you started in the real estate market.

Whether you use passive methods like stocks, REITs, REIT ETFs, and crowdfunding, or if you jump into the deals themselves, real estate investing is like any other business—do your homework and put in the time and you can see great results.

For more info on real estate investing, check out our guide to other types of investments here.