In some states, especially Minnesota, contract for deed is a popular alternative to a traditional mortgage. What is contract for deed? It is a type of seller financing where monthly payments are made to the seller over a prescribed time period. Unlike a traditional mortgage, however, the property deed remains with the seller, and while the buyer occupies the property, the buyer will not actually own the premises until all payments have been made.

Why Do a Contract for Deed in Minnesota?

Contract for deed is often used when the buyer cannot qualify for a traditional bank mortgage. This problem can occur for many reasons including:

- Bad credit.

- Non-provable income.

- Business ownership.

- Divorce.

- Prior bankruptcy.

- Tax liens.

- Court cases.

- Tight lending standards.

- Appraisal issues.

- Previous foreclosure.

- High student loan debt.

- Job loss.

- Illness.

- No credit history.

Minnesota home buyers with any of the above issues may find that contract for deed financing is a nice solution.

The Advantages to Contract for Deed

The advantages of contract for deed in Minnesota include:

- No bank scrutiny.

- More flexible terms.

- Personalized interaction with the property owner.

- Bad credit is not necessarily a problem.

- Quicker turnaround time.

- Appraisals may not be necessary.

- Property improvements can be made.

- There are ownership tax benefits for the buyer.

- MN contract for deed is a great way to build credit.

- No pre-payment penalties.

The Disadvantages

Some disadvantages of a contact for deed in MN could be:

- More rapid foreclosure parameters.

- Unethical sellers could offer a contract for deed on an encumbered property.

- Higher interest rates.

- Title stays with the seller until paid in full.

Is Contract for Deed for You?

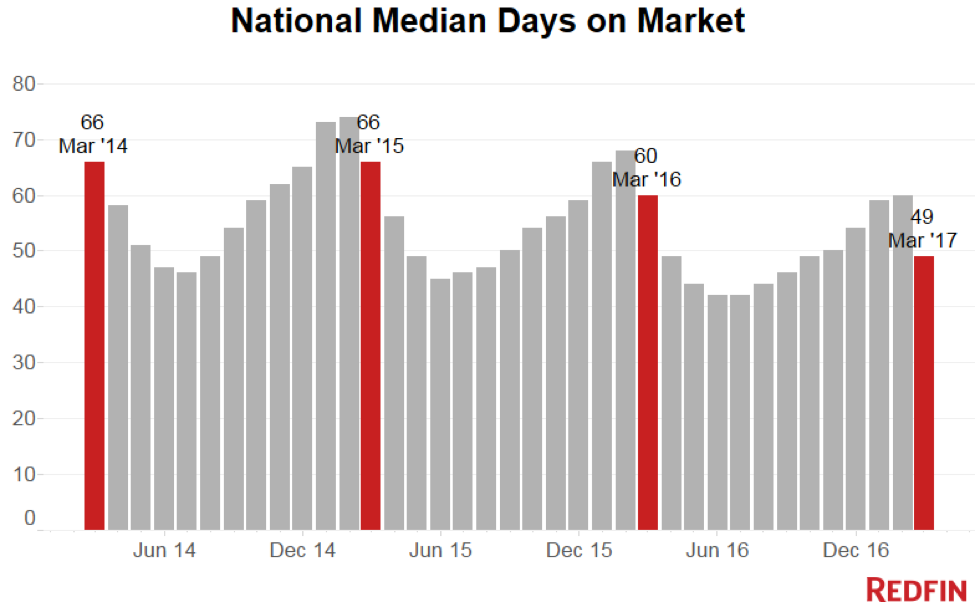

Redfin says that nationwide housing sales are still strong:

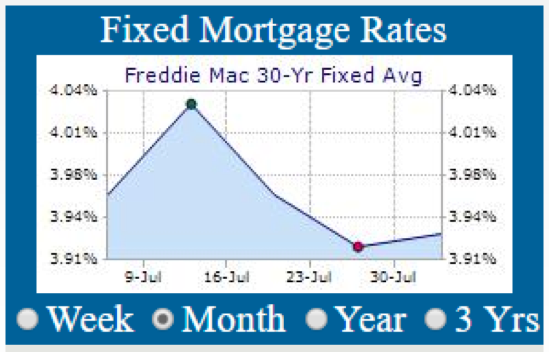

Mortgage lending requirements have somewhat loosened, more buyers can now qualify, and rates are low:

Still, if you have injured credit, you may not be able to qualify for a traditional loan, and, if you are renting, your monthly payment goes directly to your landlord with no benefit for you. This is where a contract for deed arrangement can really be an excellent benefit.

Look at this comment from the Minnesota Home Ownership Center:

“The use of contracts for deed to buy a home is on the rise. The foreclosure crisis has resulted in tighter loan underwriting standards, leading to fewer qualified buyers. At the same time, an increase in bank foreclosures means more homes are for sale at reduced prices. Investors often purchase these homes for cash and then offer them for sale using a contract for deed. Since contract for deed agreements take place without the underwriting criteria set by conventional lenders such as FHA, they are attractive to buyers that are not able to meet these restrictive requirements. Contract for deed agreements are attractive to home sellers because they open up the market to more buyers who, for a number of reasons, cannot find a mortgage-ready buyer to purchase the property.”

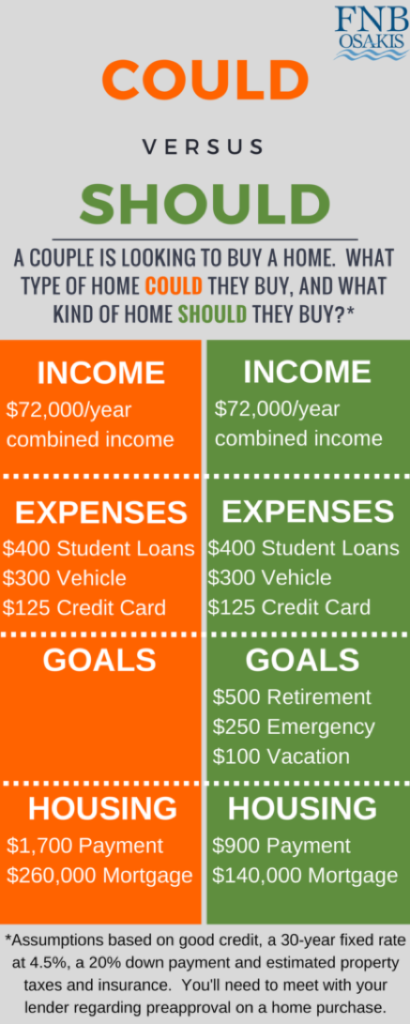

And while banks like to pigeonhole prospective buyers like this (image below), you will find a lot more flexibility with a Minnesota contract for deed transaction.

A Lot to Consider

We’ve shown that contract for deed financing can be a good alternative to traditional mortgages especially if you have credit issues. Of course, due diligence is very important, and you want to make sure that your seller legitimately desires to make the contact work for both of you. The Atlanta Legal Aid Society advises, “The key to making these agreements work is to go into them with your eyes open to all the possibilities, to make payments on time, and to work on repairing your credit to the point where you’ll qualify for more traditional financing.”

C4D

A company like C4D is a great place to start; their unique approach allows you to bring your dream home to them, they actually purchase it, and then they sell it to you. And if you want us to help you find a home, that works, too. We have a team of realtors ready to get the search started for you. These transactions are legal, regulated and fair, and even your real estate broker’s commissions are protected.

If you’ve found your home, congratulations! If you have it financed, that’s great, but if you are turned down by the bank, don’t give up—contact C4D.