Some Minnesota Realtors view the current economic situation as murky with darker clouds on the horizon. Interest rates are moving higher and some mortgage rates have crossed the psychological five percent barrier. Top luxury home prices in places like Austin, TX have begun to stagnate and actually drop. While unemployment is at record lows, inflation is starting to re-emerge as a threat, the price of oil just recently fell from a six-year record high, and of course there is geo-political chaos. None of these factors are good for the housing market.

The Comeback of No-Doc Type Loans

We are almost 11 years removed from the Great Recession that began in 2008. Some new to the real estate business may have been in their early teens when this occurred and may not remember, but no-interest and no-doc loans were part of the problems that ultimately crashed the economy.

One of our older CD4 clients tells us that they were able to get their original home mortgage with a one-page typewritten business profit and loss statement. The mortgage loan officer said, “Are you making money?” and when he got an affirmative answer, they were approved.

In the early and mid-2000s, people used their homes as ATMs, and loan officers aided by appraisers approved scores of loans. Some were no interest, some were adjustable rate, and many were made without any debt-to-income ratio verification. If someone showed that their business cash flowed significant dollars, profits and income were ignored.

Check Out CNN Lately?

Listen to CNN today and you will hear ads for a mortgage company that claims that profits don’t matter–only cash flow does. When companies can advertise nationally and get customers for low documentation mortgages—even in view of what happened in 2008—it’s time to take notice and get worried.

The Next Time for Minnesota Realtors

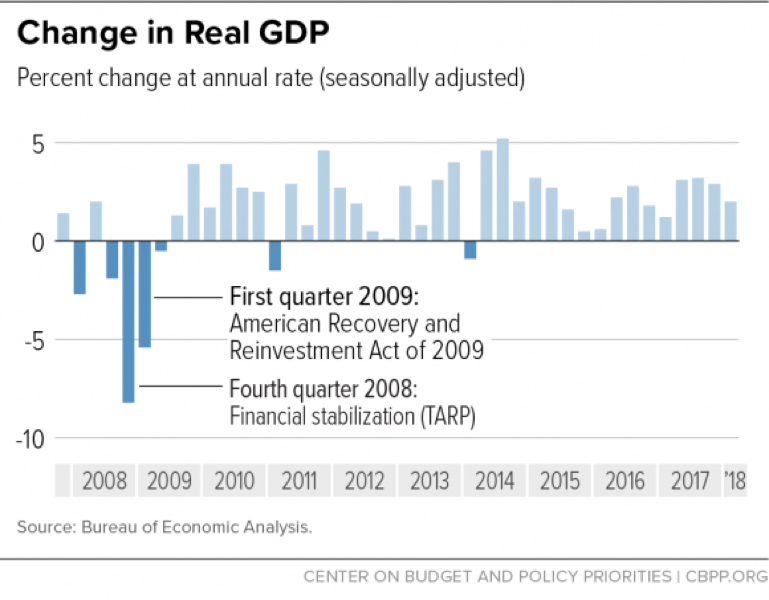

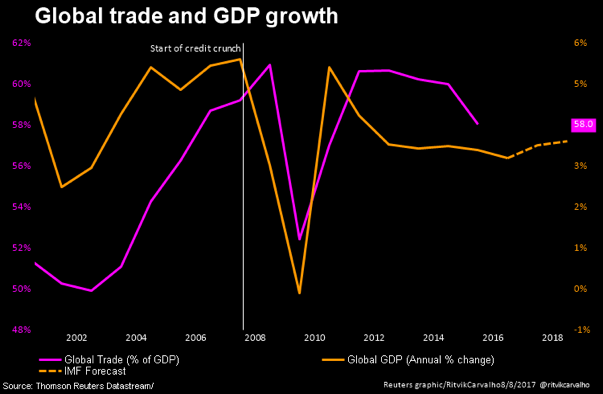

The U.S. economy is cyclical, and after the second worst downturn in history, we have now seen the longest recovery. Even though there are those that say “Well, this time is different,” savvy Realtors know that is not true. The next recession–whether it’s almost here or won’t arrive for another year–will cause difficulties for Minnesota Realtors. When the GDP falls, the stock market retreats, and interest rates go up, money tightens and loans can be hard to get. And therefore, you need C4D.

What We Do

We at C4D use MN contract for deed to help prospective homeowners that were rejected for traditional financing to realize the home ownership dream. We use our strength and knowledge as we buy homes and then resell them to your clients who were rejected for traditional financing or unable to obtain it. Yes, your clients need a job and provable income, but we can work with issues like divorce, tax liens, garnishments, bad credit and large student loan balances. We can help where others have failed.

Listen, we do not want to see an economic downturn, and we genuinely hope that one day all of our clients will be able to get traditional financing. Until that time comes, however, Minnesota Realtors can call us with rejected deals and we’ll see what we can make happen. We’ve helped a lot of people.