It’s hard enough to ascertain exactly where a certain real estate market is headed, and with the wide variety of sources available, it’s equally difficult to distill those in order to make informed decisions. We’ll try and help you understand the current Minnesota real estate market and Minnesota homes for sale.

Minnesota Interest Rates

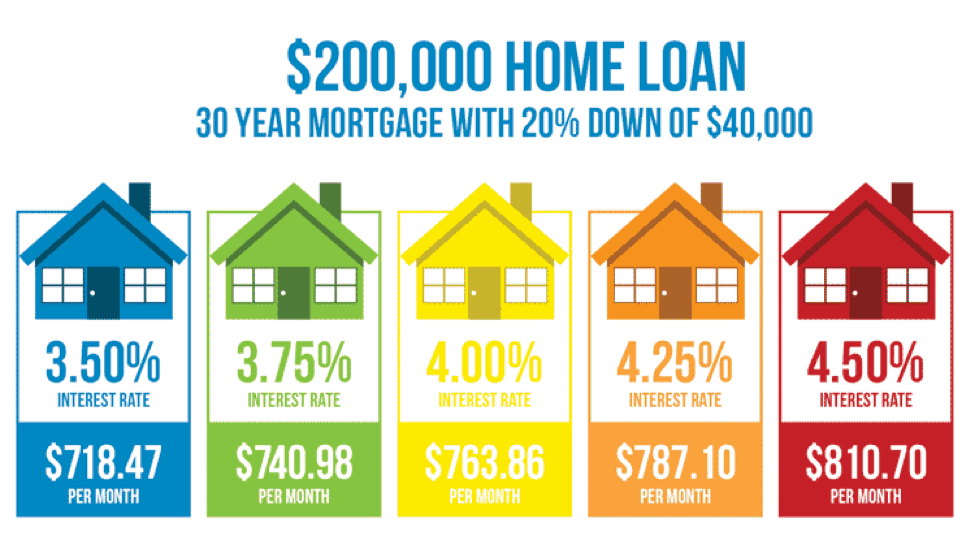

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference:

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference:

You can see that a one percent rate increase on a $200,000 home loan costs almost $100 per month. Do the math any figure the costs for more expensive homes, and you will easily view the worrisome effect that higher interest rates cause.

Interest Rate Prediction

Our friends at Kiplinger tell us:

“The Federal Reserve is committed to raising short-term rates this year and next because it’s concerned about the tightening labor market. The Fed very much wants to stay ahead of any inflation that rising wages may generate and will lift short-term rates by a quarter of a percentage point twice more this year after doing so in June. That would put the federal funds’ rate at 2.5% heading into 2019, when another three increases are expected.”

These increases will trickle down to mortgage rates, and those looking for Minnesota homes for sale will see increases beyond these current rates:

| Minnesota Mortgage Rates as of September 6, 2018 | |||

| TERM | RATE | CHANGE | LAST WEEK |

| 30-year fixed mortgage rate | 4.43% | 0.02 | 4.41% |

| 15-year fixed mortgage rate | 3.90% | 0.01 | 3.89% |

| 5/1 ARM mortgage rate | 4.16% | 0.01 | 4.17% |

| 30-year fixed jumbo mortgage rate | 4.53% | 0.05 | 4.48% |

| 30-year fixed refinance rate | 4.43% | 0.03 | 4.40% |

When the mortgage interest rate reaches five percent, this can cause Minnesota home buyers to take a step back and maybe consider staying where they are or renting.

In addition, a recent Minnesota Star Tribune article said that any price relief will have to wait until 2020:

“Relief is on its way for home buyers in the Twin Cities and beyond who are frustrated by a lack of house listings and lightning-fast sales, according to a survey of housing experts. But they will have to wait until at least 2020. That’s when experts see key indicators in the housing market tilting toward buyers. ‘Conditions are starting to show signs of easing up, but the effects of years of limited construction still linger,’ said Zillow senior economist Aaron Terrazas, cautioning that any shift will be modest. ‘Inventory is still falling on an annual basis, and home values are growing well above their historic pace.’”

Minnesota Homes for Sale: The Alternatives

So, if you are looking for Minnesota homes for sale, you’ll find a torrid market where the median home price may soon reach $300,000. Many in your position may decide to wait out this era of rapid increases and, as we previously mentioned, think about staying put or renting. Our friends at Abodo tell us this about the Minnesota rental market:

A one-bedroom apartment in St. Paul now averages $1020, and a two bedroom is priced at $1256. Both of these median prices are little changed from last month. While the nationwide rental market has shown an uptick since July, it can still be cheaper in some locations to rent rather than buy–more about this in an upcoming post.

It Can Be a Challenge

Finding your home can be stressful and financing it can be even more challenging. At C4D, our goal is to see you become a homeowner with a good, solid traditional loan. Sometimes, however, this just doesn’t work, but through our expert use of MN contract for deed, we get people into homes and put them onto the path of rewarding home ownership. Turned down at the bank? Be sure to contact us because we have helped lots of persons with credit issues ranging from divorce and job loss to bankruptcy and foreclosure.