So, you need a down payment on a house, but you do not have handfuls and handfuls of cash to make it happen. A mortgage loan can help with that, but what if you can’t get one?

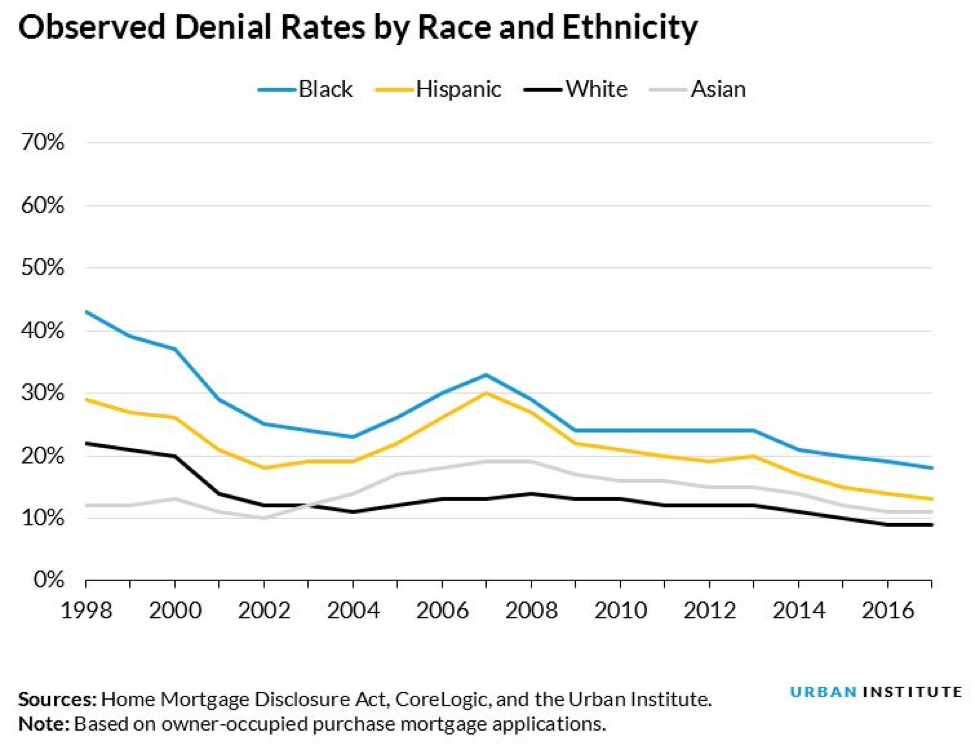

Well, many persons think that race and ethnicity are major factors in mortgage loan denials, and the following chart backs this up:

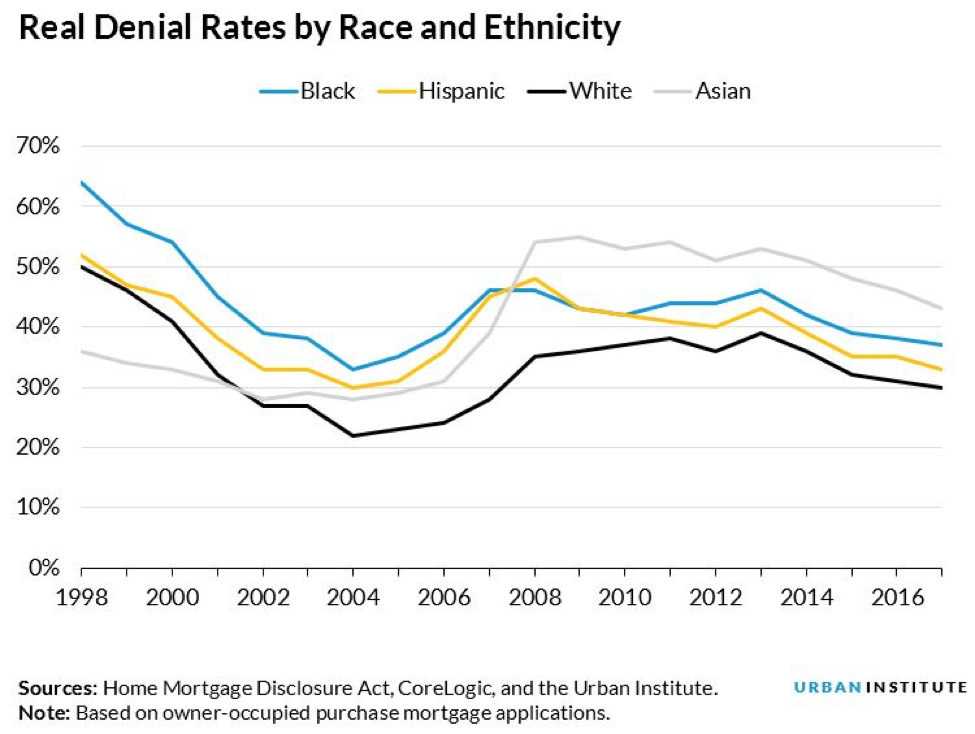

Others, however, feel that observed denial rates do not give the true picture, and that what is called “real” denial rates paint a truer picture:

According to Urban Wire, “the real denial rate is still a blunt tool, because it requires the simplification of complex data and trends. It considers credit scores, loan-to-value ratios, debt-to-income ratios (DTI), and product and documentation types, but it does not consider income or income variability (we only have access to DTI; the lender will have more detailed financial information).”

Mortgage Loan Denial: Racial Profiling?

Statistics can be molded to show whatever authors want them to show, and both charts seem to portray that more minorities are denied mortgages than whites. Of course, there could be many reasons for this, and the raw data just does not tell us what that is.

Some think, however, that if a person of color walks into a mortgage lender’s office—even if they have a down payment on a house–the would-be borrower is automatically subjected to a higher level of scrutiny that then causes them to become credit denied. While this can be possible, these anomalies don’t guide the way we do business at C4D.

Down Payment on a House: We Can Help

Whether you are Asian, white, black, Hispanic or a Native American, we just don’t care. We know that good people can simply have bad credit problems. We understand that your credit rating may have been injured because:

- You lost a job within the last year.

- You have a lot of student loan debt.

- Your credit cards are maxed out.

- You got a divorce.

- You owe taxes to the state.

- You have legal judgments against you.

- You declared Chapter 13 or Chapter 7 bankruptcy.

- You defaulted on a personal loan.

- You faced foreclosure.

- You don’t have a large enough down payment on a house.

There can be many other reasons that you may not qualify for traditional financing, but we at C4D are here to help you. We utilize a very innovative program called MN contract for deed. It works like this:

- You find a house.

- We buy it.

- We sell it to you on a MN contract for deed basis.

- We keep the deed until you make all of your payments.

Yes, you still will need a down payment on a home, but we consider things that a bank does not.

Our Process to Help with Your Down Payment on a House

Fill out our online application, and we will evaluate your situation. If there is any way we can help you, we will first talk on the phone, and then we will get together personally. We do work with a local bank, and the bank respects our judgment. If we can make a good case that you have a down payment on a house and that you will be able to make the payments, we do everything possible to get the deal done.

We have said it before: We love traditional financing and wish that everyone could get a standard mortgage. If you can’t, however, don’t give up. Talk to us today!