Unless you can get a VA no-down payment loan, you are going to work on saving money for a house for a first home deposit. Conventional mortgages usually require at least five percent down, and FHA loans will ask for three percent. If you are buying a second home or if you have compromised credit, you will have to come up with more cash. Let’s look at some ways to accumulate that elusive down payment when you are saving money for a house, including those awesome side gigs.

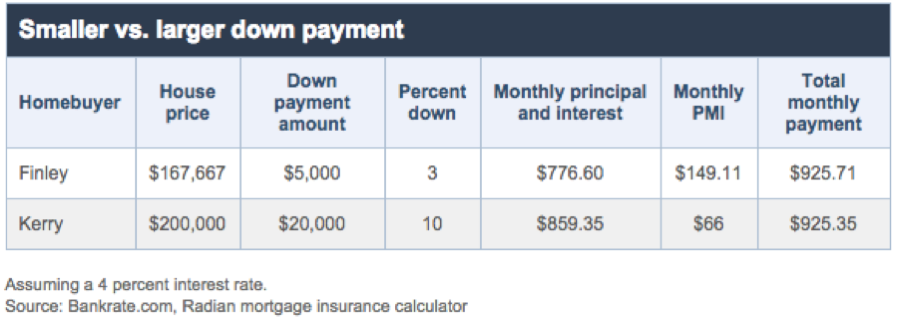

Image via bankrate.com

Treat Money Wisely

You don’t necessarily have to go on the peanut butter only diet to save cash, but with some commodities like milk, the bottom of the shelf brand that the stores try to hide is probably the same product as the more expensive nationally branded milk. Try it, and if it tastes the same, buy the cheaper brand and you’ll save money every week.

Pay Yourself

According to SavingLoop, “it’s important to set up a bi-weekly direct deposit to a savings account—same as a deduction taken from your check. You won’t feel it, and you will accumulate dollars fast.”

Ditch the Corvette

*Save money with a Kia lease

Get a sensible car that is reliable. Think KIA Soul, and if you can drive a manual transmission, you can lease one of these for under $200 per month.

Become a Landlord

Rent your garage or an extra bedroom and pick up cash monthly. This strategy really helps saving for a house. Let’s say you have an apartment in an area like Uptown, well, maybe you have a money-making opportunity on your hands. Rent it out!

Sell It to Start Saving for a House

Old cards, vintage guitars and collectibles that you never will use can sometimes fetch great prices. If you are not using it, turn it into cash.

Don’t Be a Walmart Snob

Stuff is cheaper there and you can really save some money at Costco. It really is. That $4.50 two-ounce tube of cortisone cream you just bought at CVS is probably sold at Walmart for two bucks. Check out dollar stores as good retail alternatives also, and saving for a house will be less of a hassle.

Get a Side-Hustle to Start Saving for a House

This means a second income stream. Cut lawns, wash cars, walk dogs, babysit, work catering gigs; just find out what else you are good at beside your regular job and work a few extra hours.

Locate Your Rich Uncle

Your family may include someone that will loan you down payment cash. Don’t be afraid to ask.

Buy a Smaller House

If your dream home is out of reach, go intermediate and buy a smaller or starter home. Treat it nicely and in a few years, you can sell it and move on up.

Find a Duplex

If you have only saved a minimum down payment, find a duplex where you can rent the other side. While this falls into the starter home category, think of the advantages that having someone else paying half of your mortgage will afford you.

All in all, there are a ton of ways to save money; we’re not saying one is better than the other. A lot of people use really cool apps like Digit, but there are a ton of ways you can do it, too.

As you know we, at C4D really hope you can get traditional financing. But if you can’t, be sure to let us know. Yes, we also require down payments, but our innovative use of MN Contract for Deed has allowed us to help many that had previously thought home ownership was impossible. Be sure to contact us!