Buying a home with bad credit can be virtually impossible for some people. And if you’re a person who is impacted by a terrible credit score (reasons below), then renting a home or apartment may seem like a great idea.

You’ll have no taxes, no maintenance, no real long-term commitments, and you won’t be stuck with a property you don’t want if you decide to move. But when you realize that your monthly rent payment is just like a car lease payment with none of it applying to equity, you may decide it’s time to become a homeowner. If your credit score is low, and you are unable to qualify for a mortgage, then you you may want to look at non-traditional financing.

Here are some reasons that you might not qualify for a mortgage loan:

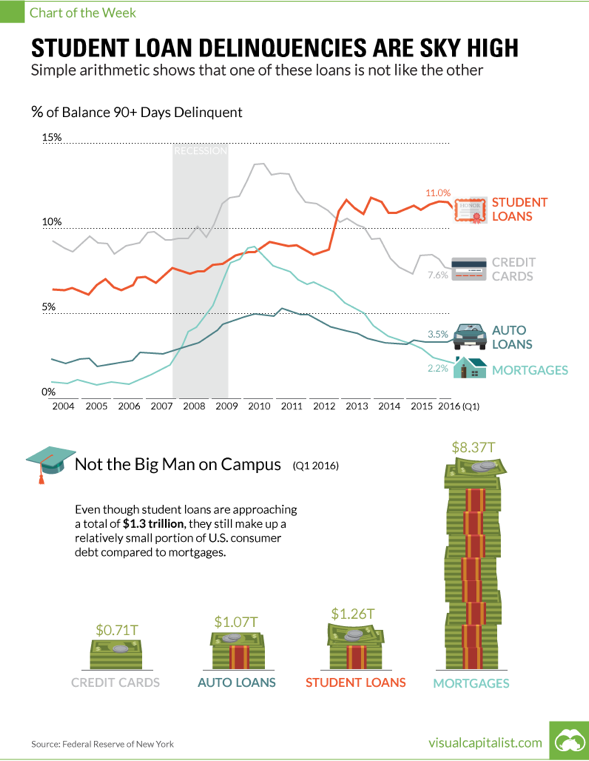

- you have delinquent student loans,

- overdue credit cards,

- late auto payments, or

- bad Minnesota credit.

And just take a quick glance at this chart and you’ll see why student loans are such a HUGE issue.

If this is the case for you, and you truly are serious about buying a home with bad credit, then check out these methods to buy your dream home:

Get Someone to Buy It for You

If you’re lucky enough to have a rich uncle, maybe he or she will purchase the property for you and put your name on the deed. You could make the mortgage payments and start building equity.

Work on Your Credit Score

Alternative financing for people who take aim at buying a home with bad credit is sometimes necessary because your credit report is incorrect. Avoid the necessity of finding MN bad credit financing by obtaining your credit report at Credit Karma and following the proper procedures for correcting errors. The folks at myFICO say:

“It’s important to note that repairing bad credit is a bit like losing weight: It takes time and there is no quick way to fix a credit score. In fact, out of all of the ways to improve a credit score, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast. The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you need to repair your credit history before you see credit score improvement.”

Do a Rent to Own

In a rent to own transaction, those looking for MN bad credit loans can purchase a home by entering into a rent to own agreement. With a very small deposit, renters can arrange for a portion of their monthly rent payments to be put toward a down payment or a reduction in the final home selling price. These transactions are complicated, however, and it’s important to gain legal representation before signing any rent to own contract.

Get a Private Mortgage

You don’t have to get a mortgage from a bank; anyone can lend you the funds. Maybe your boss, a relative or a private lender would be willing to help. You could offer to pay a higher interest rate or could offer to pay an origination fee.

Buying A Home With Bad Credit? GO FHA

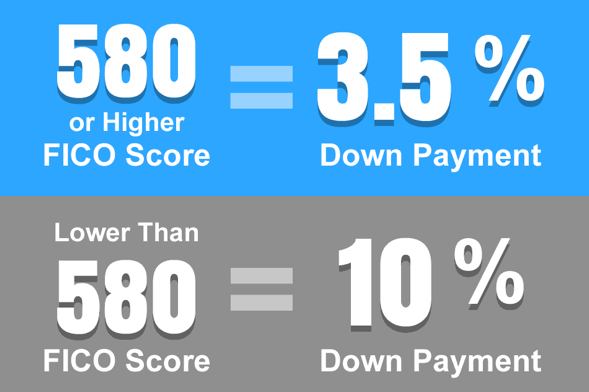

Even with a low credit score, FHA loans can still be a possibility:

These can be obtained through any participating mortgage lender. Even if you have a previous foreclosure or bankruptcy, FHA federally guaranteed loans can be a great option.

Get a Contract for Deed Deal

Minnesota contract for deed loans are commonplace. In this scenario you first find a property for sale by owner. Then, have the owner agree to sell you the property on a contract. While many contract for deed sales are straightforward, legal representation is very important here, because a sale of property already encumbered by tax liens and/or judgments, for example, can cause you big trouble.

A Great Place to Find Help

C4D is a well-respected and established company that helps Minnesota home buyers with bad credit through the process of becoming a homeowner. While there are other agencies and companies that will assist, C4D is directly plugged in to the MN contract for deed network. Maybe think about contacting us while you search for bad credit financing.