The Major Tax Benefits of Homeownership in 2019

https://www.c4dcrew.com/wp-content/uploads/2019/01/CONTRACT-FOR-DEED_-PROS-AND-CONS-30.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gHome ownership is still a great deal, and you can save substantial tax dollars because of it. In 2019, however, some of the benefits of home ownership have been curtailed, and those interested in exactly what a homeownership tax credit does should read on.

What is a Tax Deduction?

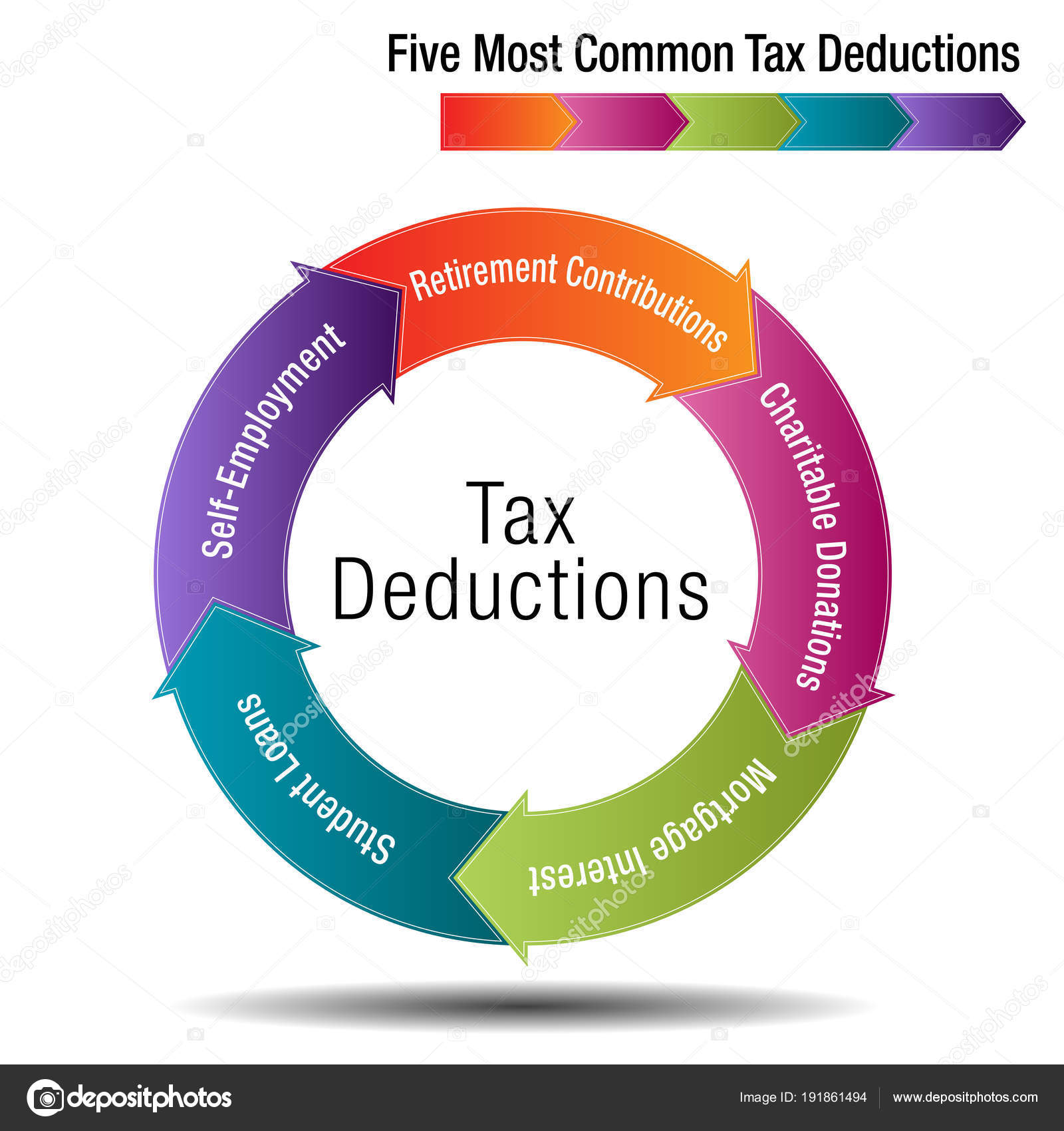

There is a difference between tax deductions and tax credits. A tax deduction is an amount that you can subtract from your gross income. In previous years, the IRS allowed what they call the standard deduction; that was $12,000 per year per married couple.

That meant if you earned $60,000 in 2018, and were filing jointly, you would be about to immediately deduct $12,000 from your income and pay taxes only on the remaining $48,000.

An image of a Five Most Common Tax Deductions Chart.

For the tax year 2018, the standard deduction has been increased to $24,000. That means that on a combined income of $60,000, you and your spouse could deduct $24,000 and pay taxes only on $36,000.

The caveat here is that you can either take the standard deduction, or you can itemize expenses, add those up, and use that amount as your deduction. The purpose of doubling the standard deduction was to keep people from having to itemize and save receipts.

What Is a Tax Credit?

A tax credit is something that would actually reduce the amount of taxes that you owe, like the American Opportunity tax credit that applies to attending college.

There is not a national homeownership tax credit per se. Yes, you can deduct a certain amount of mortgage interest and property taxes, but it may be more advantageous to just take the new higher standard deduction. The mortgage deduction amount for the year 2019 has been capped, and so has the property tax deduction amount.

IRA Considerations

If you are considering the use of your IRA to fund a down payment, tax laws do allow you to forego paying IRA withdrawal taxes up to a certain amount. Be sure to check with your CPA regarding this.

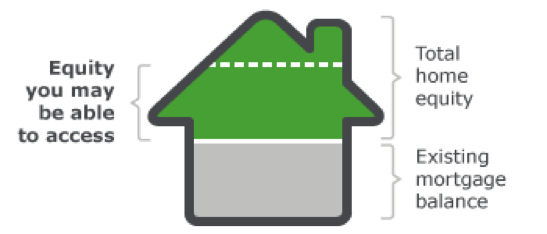

Home Equity Interest Loan Deduction

Again, this is not a homeownership tax credit, but you can deduct a certain amount of home equity loan interest if you have taken out a home equity loan.

Capital Gains Exclusion

Our friends at NOLO tell us:

“Married taxpayers who file jointly get to keep, tax free, up to $500,000 in profit on the sale of a home used as a principal residence for two of the prior five years. Single folks (including home co-owners if they separately qualify) and married taxpayers who file separately get to keep up to $250,000 each, tax free.”

The Comparison

Remember, if you are renting, there are no possibilities for mortgage or property tax interest deductions, and you can’t take out a home equity loan so that deduction will be unavailable also. There are certain states that offer a homeownership tax credit, and renters from Bloomington, Indiana to Eugene, Oregon are out of luck here also.

As you can see, home ownership still provides a lot of tax incentives, and states provide worthwhile homeownership tax credit. If you are unable to get traditional financing, these tax breaks can still be yours through the use of MN contract for deed.

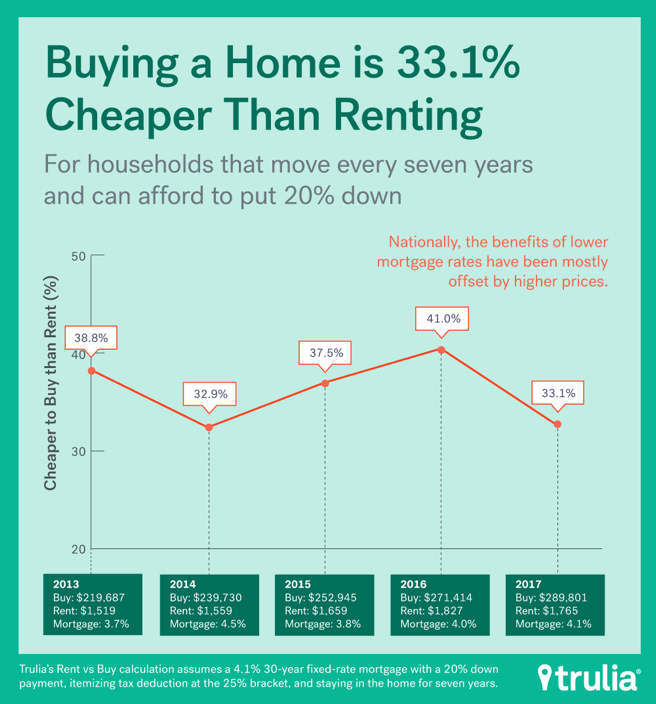

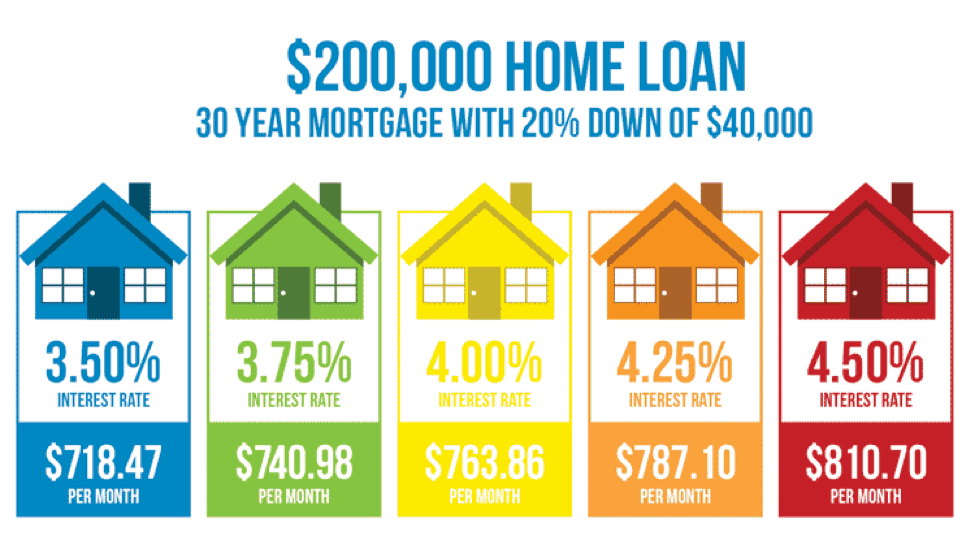

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference:

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference:

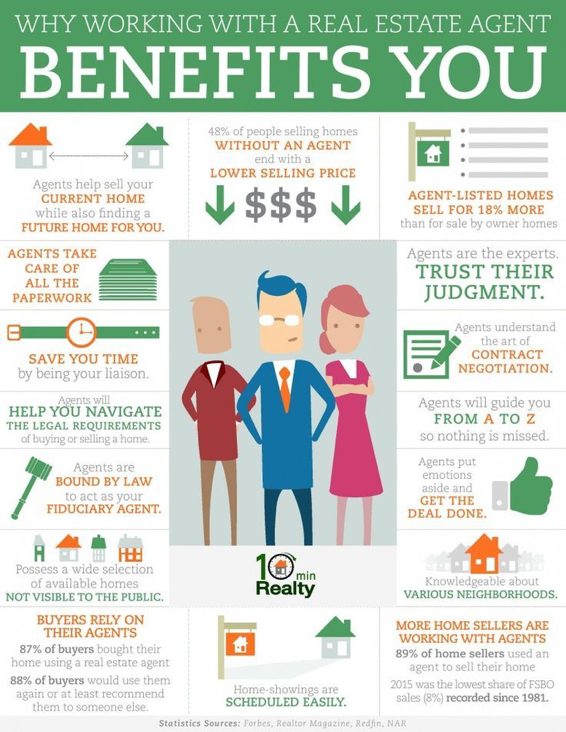

First, there is a difference between a Realtor and a real estate agent. You can be a real estate agent without

First, there is a difference between a Realtor and a real estate agent. You can be a real estate agent without