Buying A House After Divorce: Yes! It’s Possible.

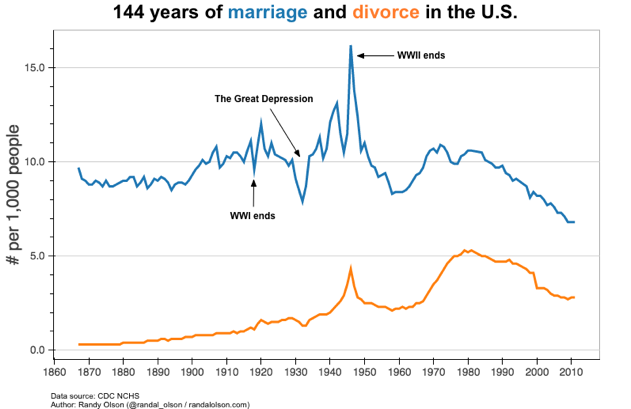

https://www.c4dcrew.com/wp-content/uploads/2018/06/CONTRACT-FOR-DEED_-PROS-AND-CONS-24.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gBuying a house after divorce is a huge issue for many people across the country. To start, divorce can cost you a fortune. What else you ask?

Well, let’s face it, divorce is rarely stress free, and your recent interaction with the family court system is probably something you never want to go near again. You’ve spent time away from work, agonized about visitation rights, thought endlessly about money making ideas and paid some hefty legal bills, but the fun is just beginning because your spouse is occupying the residence and now you need to buy another one.

Why Is That a Problem?

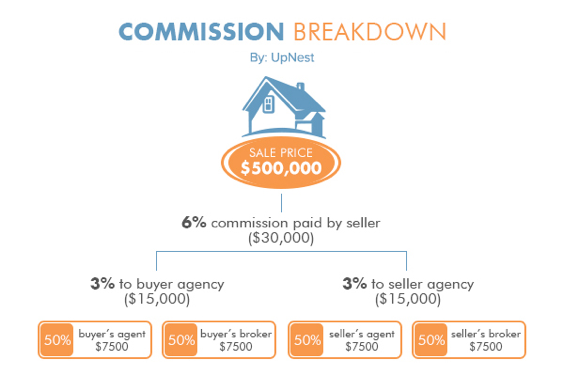

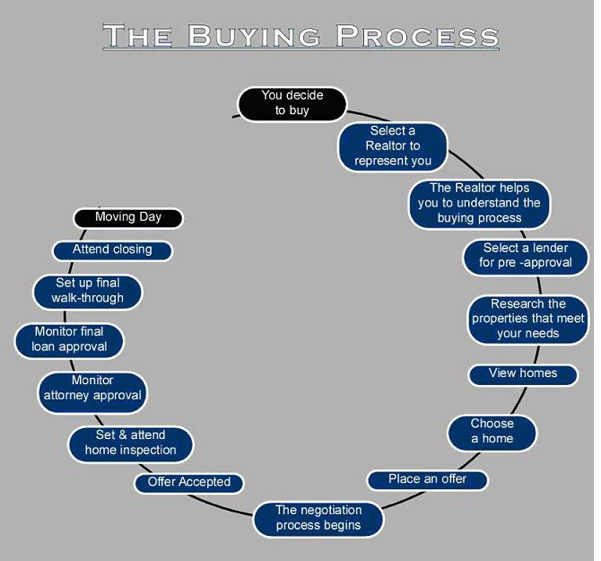

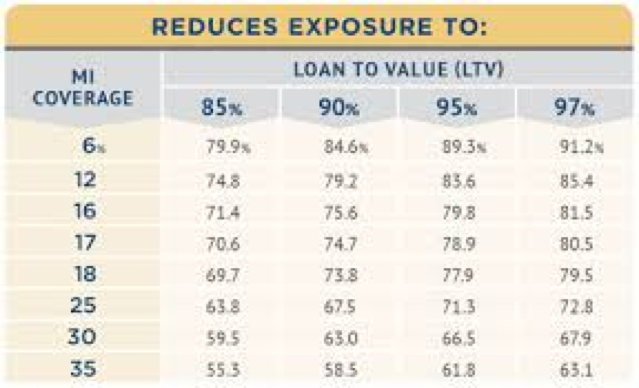

If your name is on the deed and the mortgage, even though you may not be living in the house, you are 100 percent responsible for that monthly payment according to potential mortgage lenders. If your ex has been making that payment, lenders will want proof that he or she has been able to handle the obligation for the past 12 months, and will ask for documentation. Yep—more bank statements, ACH confirmations and cancelled checks for you to dig up.

The bank may even want to see proof of your ex’s income to make sure that you are not making house payments in her name. Then they will probably ask for information about where you are living even if you are renting. Who is paying for that? Can you produce the proper documentation that shows you can handle your monthly rent without assistance?

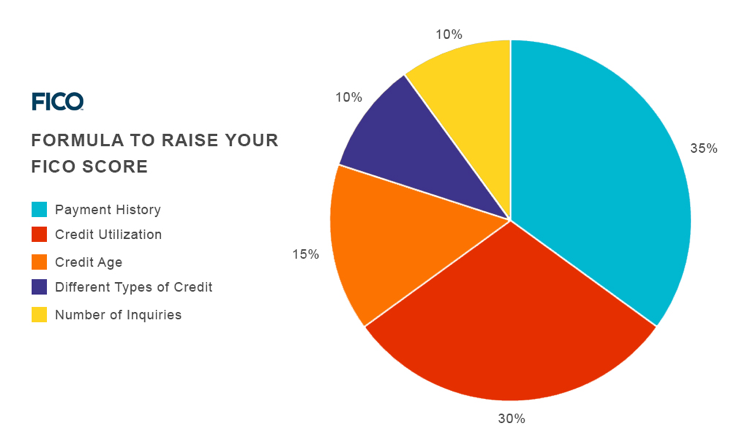

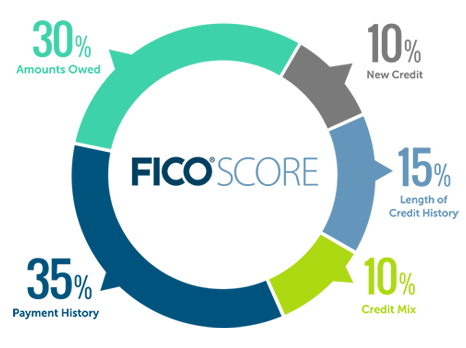

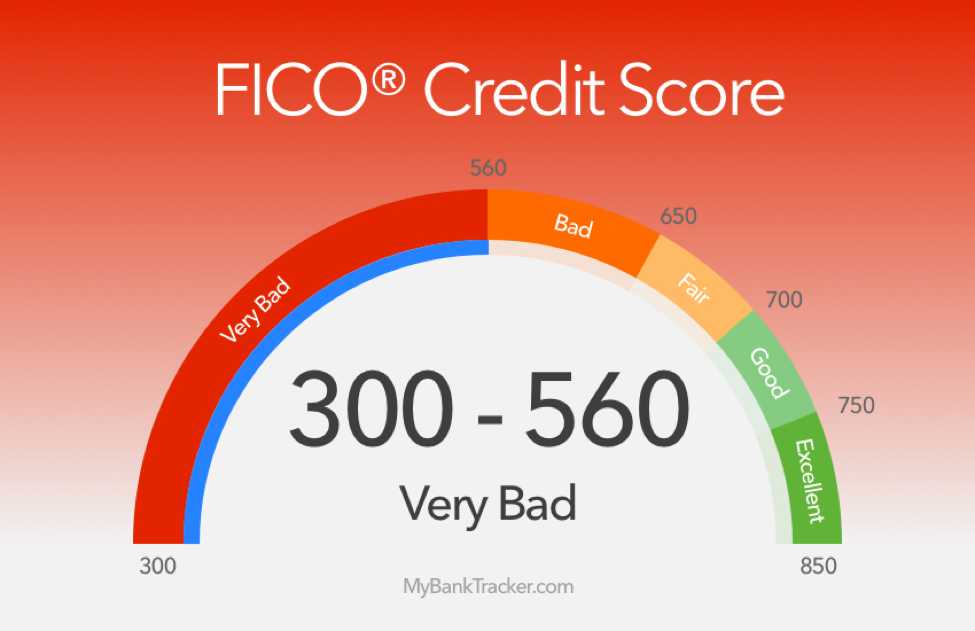

Even if you can definitively prove that your ex has successfully made 12 months of payments, you could still be denied because you are, in effect, still a co-signer on the mortgage. This can also lead to MN bad credit as your credit score could be impacted.

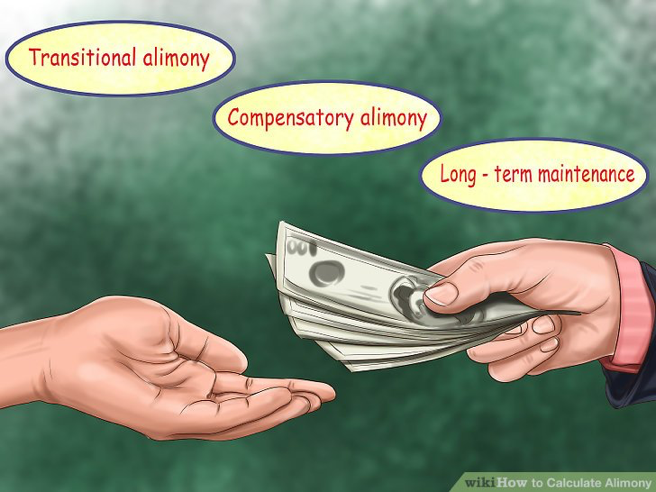

Alimony and Child Support

Not your favorite words, we know, and any court-ordered payment amounts will count against your income and injure your debt-to-income ratios. A $1500 monthly payment can cause outright rejection, or at the least, may cause you to qualify for a much smaller loan amount.

Have You Ever Been Sued?

If you were involved in a divorce you probably were, and must answer this question affirmatively. The answer will need lengthy explanation and can open the door for other queries from the lender.

Divorce Decree

Of course, the lender is going to want to see your fully executed decree; they are not going to take your word for anything.

Joint Accounts

Student loans, credit cards, autos, furniture purchases and more can be considered joint accounts. Even if your ex splits these with you, you will need to get your name off of the ones he or she is now responsible for. Again, if you name is on it, the lender will assume you are responsible for the debt, and you may qualify for nothing.

The Answer: Buying A House After Divorce

When traditional financing brings you roadblocks instead of the key to a new home, there can be answers, and MN contract for deed can be an excellent way to become a homeowner—even if you are in the midst of a divorce. Our experts at C4D, a local Minnesota company, have, over the years, worked out a method to make you a homeowner.

Using MN contract for deed, a legitimate and recognized alternative financing method, we can look past things that traditional lenders can’t. Yes, we still want income proof, you have to have a job, and have to be able to afford your payment. We, however, view these requirements differently than traditional lenders, and we helped many recently divorced persons again purchase homes.

Contact us today to find out the details!