Explore Minnesota This Summer: Must-Do Activities and Boating on Lake Minnetonka

https://www.c4dcrew.com/wp-content/uploads/2024/06/C4D-Post-Design.png 1000 500 Taylor Witt Taylor Witt https://secure.gravatar.com/avatar/929cbb327a14541f261a18eb19f98ae655626081315c630086c34e67b7853acf?s=96&d=mm&r=gAs the summer sun graces Minnesota with its warmth, the Land of 10,000 Lakes beckons adventurers and relaxation-seekers alike to discover its myriad attractions. From urban adventures to serene natural escapes, Minnesota offers a wealth of activities to make the most of the season. Among these, boating on Lake Minnetonka stands out as a quintessential experience that embodies the essence of summer in the North Star State.

Urban Escapes and Cultural Gems

Start your summer exploration in the vibrant city of Minneapolis, where cultural experiences abound. Visit the iconic Minneapolis Sculpture Garden and marvel at the famous Spoonbridge and Cherry sculpture, a favorite among locals and tourists alike. Explore the historic Mill District and learn about the city’s milling heritage at the Mill City Museum. Don’t miss the chance to stroll across the Stone Arch Bridge for breathtaking views of the Mississippi River and the city skyline.

Outdoor Adventures in State Parks

For outdoor enthusiasts, Minnesota’s state parks offer endless opportunities for hiking, biking, and wildlife watching. Head to Gooseberry Falls State Park along Lake Superior’s North Shore and hike the scenic trails that lead to cascading waterfalls. Voyageurs National Park, known for its interconnected waterways and pristine wilderness, is a paradise for kayakers and canoeists seeking solitude amidst nature’s splendor.

Boating Bliss on Lake Minnetonka

No visit to Minnesota in the summer would be complete without a day spent boating on Lake Minnetonka — a top-ranked boating spot by Getmyboat. Just a short drive west of Minneapolis, this sprawling lake spans over 14,000 acres with 125 miles of shoreline, making it one of the largest and most popular lakes in the state. Whether you’re an avid sailor, a fan of water skiing, or simply enjoy leisurely cruises, Lake Minnetonka offers something for everyone.

Rent a pontoon boat or charter a yacht and set sail across the lake’s clear waters, exploring its numerous bays and islands along the way. Discover secluded coves perfect for swimming or drop anchor near one of the lake’s many restaurants for a waterfront dining experience. Fishing enthusiasts can cast their lines in search of bass, walleye, and northern pike, while birdwatchers can spot ospreys and bald eagles soaring overhead.

Community Events and Festivals

Throughout the summer, Minnesota comes alive with festivals and community events that celebrate its rich culture and heritage. Attend the Minnesota State Fair in St. Paul, a beloved tradition featuring everything from butter sculptures to live music performances and exhilarating rides. Experience the vibrant arts scene in Minneapolis during the Uptown Art Fair, where local artists showcase their work amidst live entertainment and delicious food trucks.

Relaxation and Lakeside Dining

After a day of exploring, unwind at one of Lake Minnetonka’s waterfront restaurants and enjoy fresh seafood or a refreshing drink with stunning views of the sunset. Several marinas and yacht clubs along the lake offer amenities such as boat rentals, fuel docks, and lakeside accommodations, ensuring a comfortable and memorable stay.

Conclusion

Whether you’re seeking urban adventures, outdoor escapades, or tranquil moments by the water, Minnesota promises an unforgettable summer experience. Boating on Lake Minnetonka encapsulates the spirit of this season, offering relaxation, recreation, and the beauty of Minnesota’s natural landscape. As you plan your summer itinerary, be sure to include a visit to Lake Minnetonka and discover why it remains a cherished destination for locals and visitors alike. Embrace the warmth of the season and create lasting memories in the heart of the North Star State.

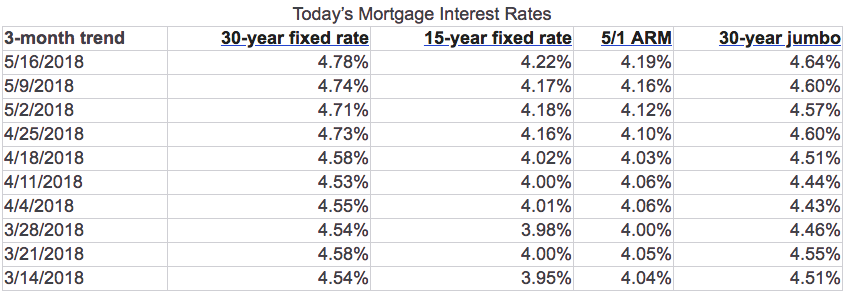

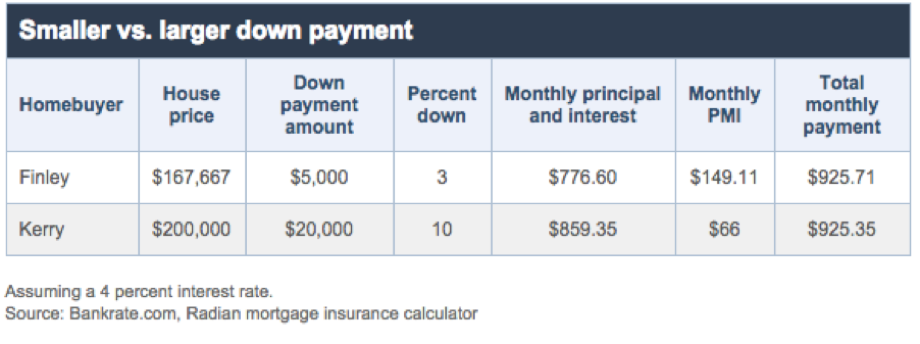

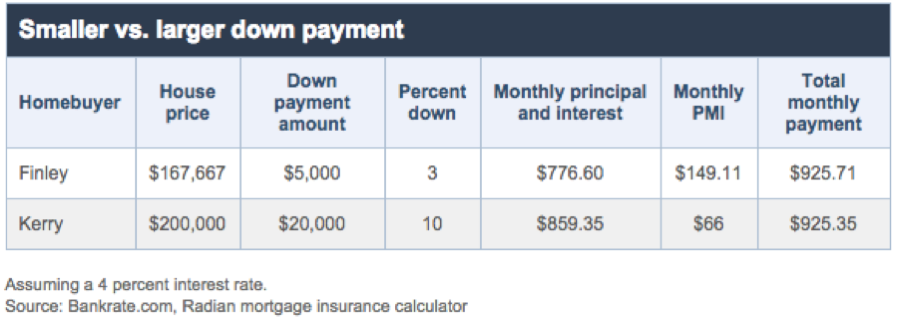

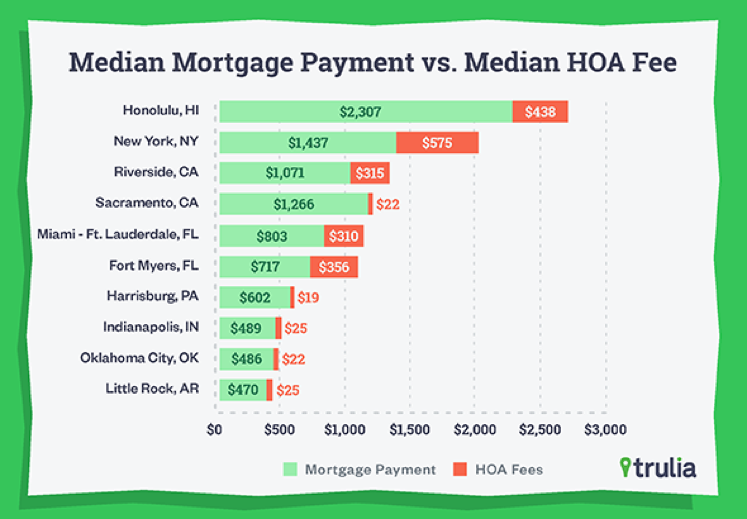

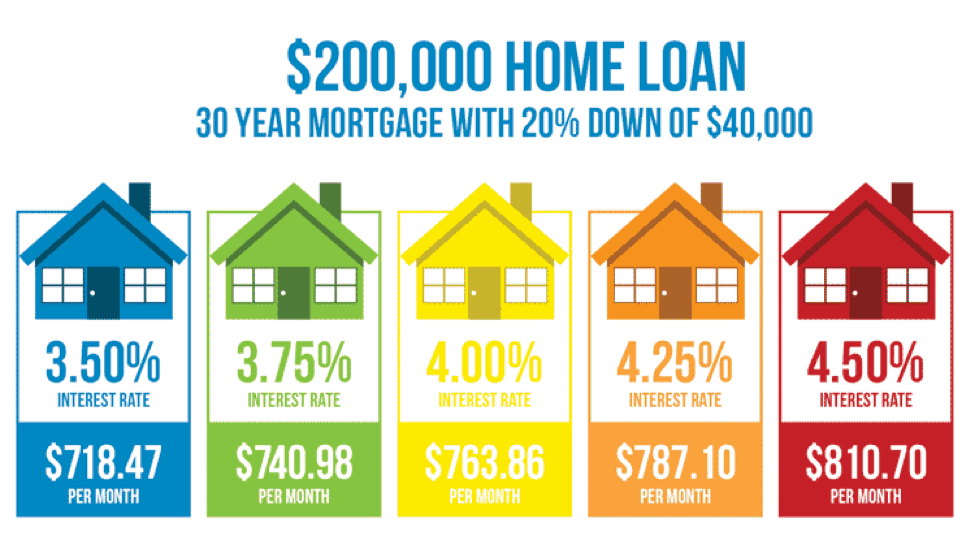

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference:

It’s obvious that the Fed’s policy of keeping interest rates low has revived the housing market. Two years ago, you could still get a rate just at or even below four percent if you had excellent credit. Look at this chart to see the effect of a one percent mortgage rate difference: