Your Guide To Buying A Foreclosed Home

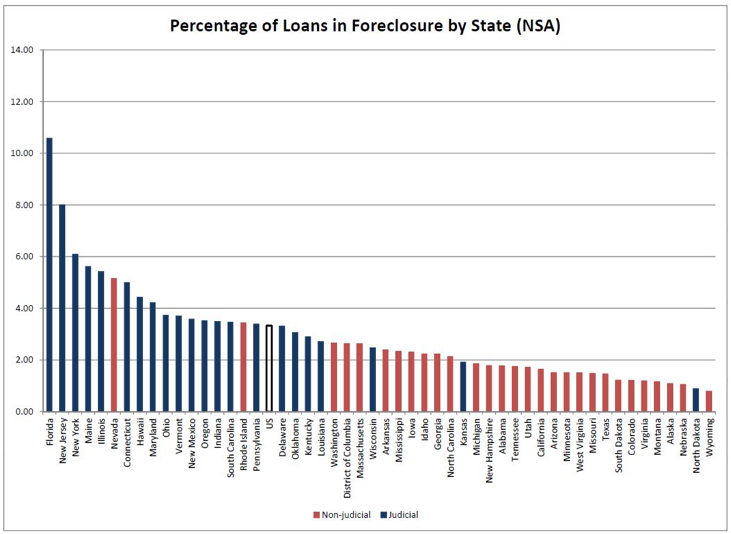

https://www.c4dcrew.com/wp-content/uploads/2018/08/CONTRACT-FOR-DEED_-PROS-AND-CONS-33.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/0cd60208d9de9b4ec7236a52868375f0187854b5ee1fefa7603d0294819d3045?s=96&d=mm&r=gBuying a foreclosed home became extremely popular about a decade ago. Why? Well, the problems that began in 2009 led to a meltdown that created scores of opportunities for both investors and previously foreclosed homeowners that wondered if they’d ever purchase a home again after foreclosure.

Over 5 million homes were foreclosed since then, and many investors have looked upon these as opportunities.

Since HGTV shows like Flip or Flop have become popular, many people think they are familiar with what a foreclosure is, and they think they can make big money by picking off great property values before someone else does. We advise you to be careful.

What is Buying a Foreclosed Home?

When you are looking at a home that is listed as a foreclosure, you need to understand what that means. Is this home in foreclosure, is the seller trying to avoid foreclosure, is someone offering a short sale, or is the property genuinely bank owned?

How Does Buying A Foreclosed Home Work?

Usually, after a homeowner crosses the 90 day past due mark, the lender will begin the foreclosure process. This simply means that the lender begins the legal work necessary to take back the collateral—the home—that the homeowner placed as security with the lender. Unfortunately for Minnesota debtors, MN foreclosures are many times non-judicial; this means that properties can be taken back outside of the court system. Foreclosures can take a lot longer in judicial foreclosure states like Wisconsin. Our friends at alllaw.com tell us this happens as follows in Minnesota:

Notice of the Foreclosure

In Minnesota, a foreclosing party must give the defaulting borrower the following notices.

Notice of the default. In most cases, the foreclosing party must mail the borrower a written notice of any default before officially starting a foreclosure. The notice must provide the borrower with 30 days to cure the default.

Notice of availability of foreclosure prevention counseling. Along with the notice of default, the foreclosing party must also provide notice that foreclosure prevention counseling services are available and that the homeowner’s contact information will be sent to an approved foreclosure prevention agency.

Notice of sale. To start the foreclosure process, the foreclosing party must first file a notice of the pendency of the foreclosure with the county recorder’s office. After filing the notice of pendency, it must publish a notice of sale for six weeks before the sale. The foreclosing party must also serve a notice of sale to the occupant of the home four weeks prior to the sale.

Foreclosure advice to owners and notice of redemption rights. Along with the notice of sale, the foreclosing party must provide a foreclosure advice notice, which provides information about how to get help, as well as a notice of redemption rights providing information about what happens after the foreclosure sale.

The foreclosure advice notice must also be provided with each subsequent written communication mailed to the borrower. A foreclosing party is deemed to have complied with these requirements if it sends the foreclosure advice notice at least once every 60 days up to the date of the foreclosure sale.

In Foreclosure

So if you are looking at buying a foreclosed home, the actual home shown as “in foreclosure” is probably somewhere in the process described above. If you are interested in a property while it is in foreclosure you have to deal with all parties including the homeowners and all lenders. You can’t make a deal with only one of the parties involved.

Short Sale

Sometimes the homeowner gets the lender to agree to a short sale. This means that the lender may agree to take less than what is owed on the property in order to streamline the process and allow the homeowner to avoid a foreclosure appearing on their credit report. These deals can take quite a while to engineer, and again, all parties need to agree.

Bank Owned

When the foreclosure process has been completed and the collateral has been returned to the lender, the home is termed bank-owned. At this point you only need to deal with the bank or its agents, since the bank is the legal property owner.

Strategies

Foreclosures, like storage shed content sales, used to be a more quiet and shadowy business. This isn’t the case any longer, however, as foreclosed properties are commonly inundated with multiple offers as many people want to cash in on the misfortunes of others. The best way to attempt to buy a Minnesota foreclosure is with cash.

Once you have located the property you are interested in, do your diligence and find out who actually owns it. Then, if you have the power of a cash offer, you may be able to make a quick deal. Remember, with foreclosure deals we recommend that you get qualified legal help, and please be advised that this article does not constitute legal advice.

If you have any additional questions, please feel free to contact us here.