The 4 Tips To Property Investing You Need To Remember

https://www.c4dcrew.com/wp-content/uploads/2020/06/C4D-Post-Design-2-1.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gProperty investment represents one of your best possible real estate investment strategies. Property isn’t liquid, though, so you have to invest carefully. The bottom can drop out very quickly, and unexpectedly.

If you’re going to see profit, you’ve got to be savvy. Following we’ll go over four paramount tips to help you make the wisest decisions in the acquisition of real estate.

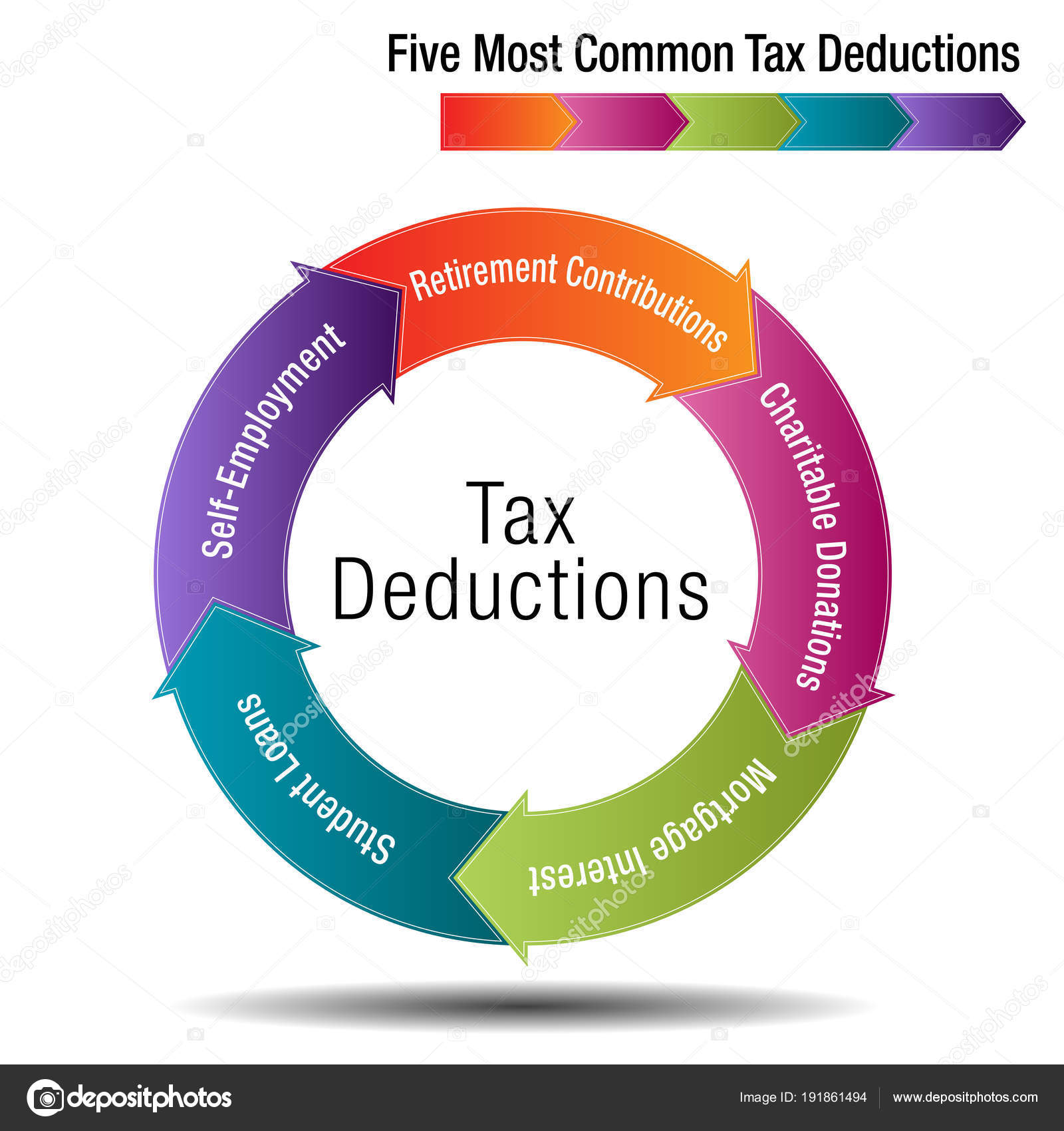

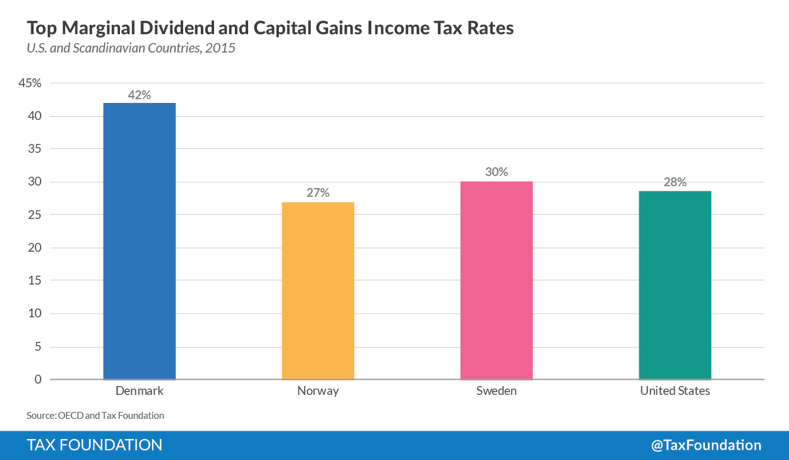

Know Taxation Associated With New Property

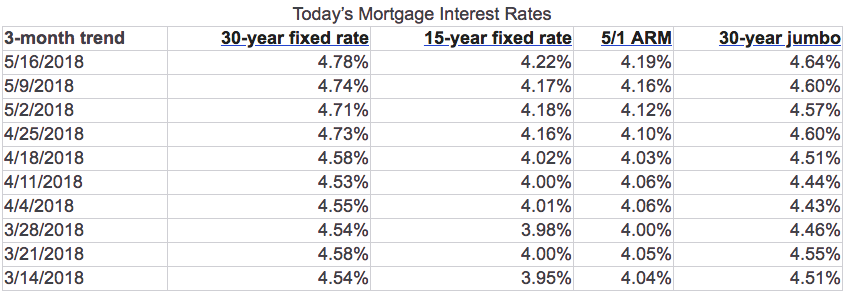

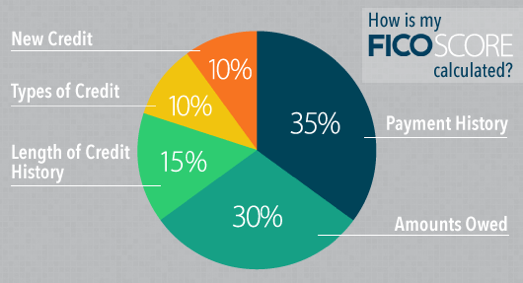

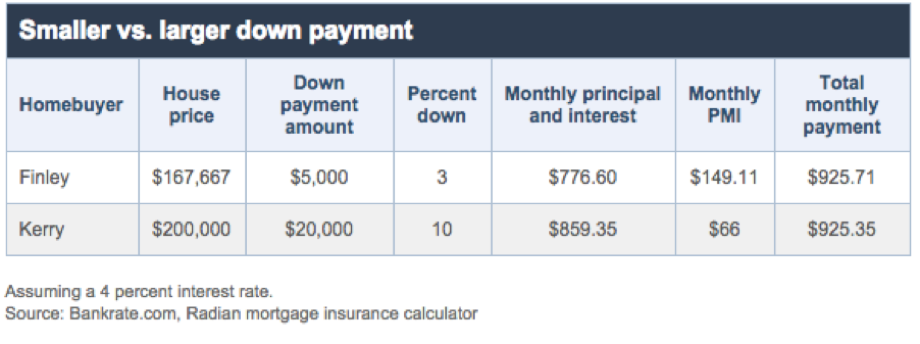

First, keep in mind the tax man. When you buy a new car, you’ve got to pay taxes on it. When you buy a new house, the same applies. The rate is usually about 4% total, depending on your municipality. That is: 4% of the total property value. Expect 1% of that to be summed up in a “transfer” tax, and 3% to be paid to the town. This site offers more insight into this. Expect tax rates to differ per locality.

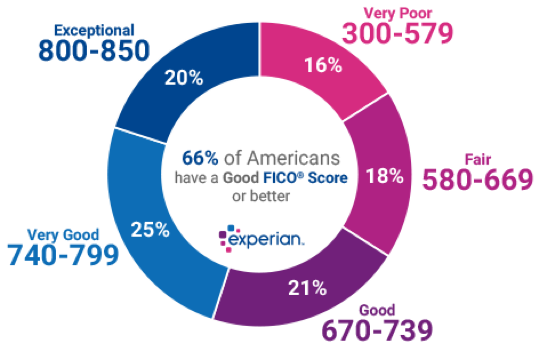

There are ways to diminish the impact of taxation, but you’ll need to be careful to do everything properly. One way this is often done is through a 1031 Exchange, wherein you sell a property and turn that money directly into a new property. This doesn’t allow you to totally avoid all taxes, however, you do have the ability to sidestep some. Buy and hold investors can also take advantage of landlord tax deductions.

Don’t Be Afraid Of Repairs And Refurbishment

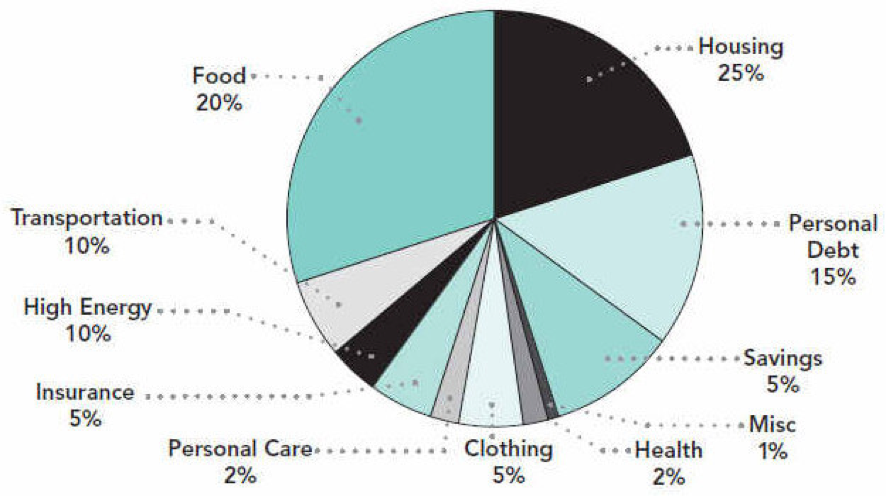

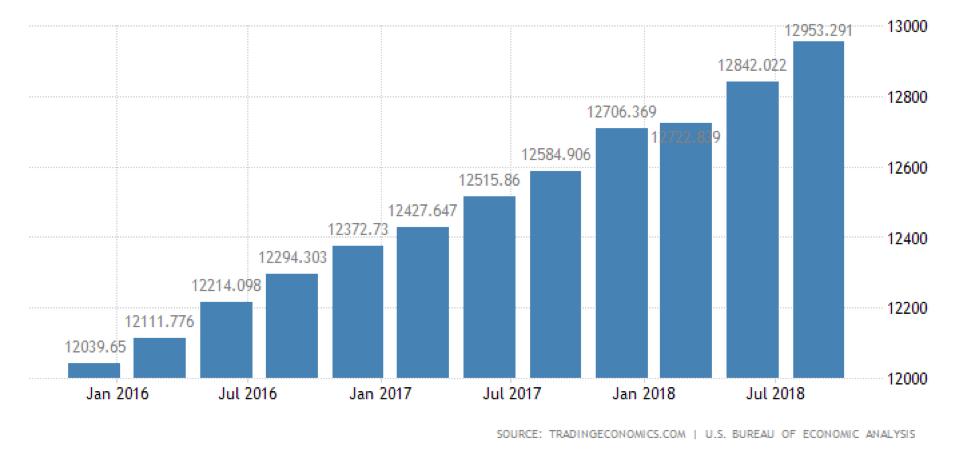

It’s possible to acquire a property at a lower rate that can be fixed up and sold at a profit. For example, say you purchase a small apartment complex with eight units for $800,000, then put $50k into refurbishment. Say when the smoke clears you’ve spent $1,000,000 on the units.

Now say you can get eight tenants in that complex for $1000 a month per unit. In 10.41 years, you’re operating at a profit. In about twenty years, you’ve doubled your money. That’s a long-term investment, and the market will likely inflate, allowing you to increase rent during that time—just buy the apartment complex in the right neighborhood.

However, on the other hand, if you’re just buying a home that’s a fixer-upper for $80k after taxes, you put $80k into fixing it up, then sell it for $250k inside two years, then you made a $45k profit each year for a total return of $90k. From there you can buy a larger property and do the same thing again.

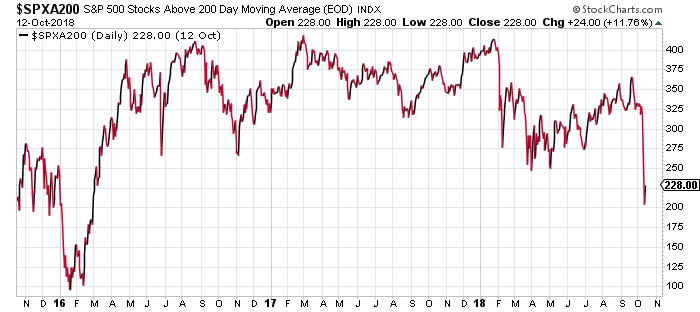

Be Very Careful To Buy In The Right Neighborhood

Neighborhoods fluctuate. One neighborhood may be trending well, then some natural disaster hits, and suddenly the bottom drops out. Certain disasters you can’t prepare for, others you can’t. Some real estate will retain its value through ups and downs with steadiness. To determine the best property, you’ll want to inform your acquisition with a consultation.

Consultation From Professionals, Realtors, Friends, And Family

Professionals in real estate can help you determine good buys. Realtors can as well, but remember they’ve got a desire to earn a commission, and they’re working their own angle; so be sure to take their advice with a grain of salt. Balance it out with information you get from friends or family who have purchased real estate before.

They can translate advice and help you make better choices. You also want to find resources like those available online to help you make the most informed choice. If you play your cards right, it’s possible to sell your property in a very professional way and even keep the commission — as ISoldMyHouse.com notes.

Purchasing property requires an equal level of strategy for best results. Provided you make a careful purchase that’s properly informed, you should see Return On Investment—or ROI, as it’s called.

Maximizing Property Investment Returns

To see true profit on your property investment, you’ll need to plan in advance and consider all the angles. Don’t neglect to factor in taxation—that will broadside you if you’re not careful. Consultation from the right people that’s balanced by multiple perspectives, doing online research, and buying in the right neighborhood will also be important.

Planning on repairing or refurbishing your property is also a wise strategy, provided you’ve got the resources and wherewithal to get the job done. Property investment and sale represents some of the most secure investment opportunities in the world. Provided you put in the proper work, and uncontrollable factors don’t impact you, you will be rewarded with true returns.