Buying your first Minnesota home can be an exciting yet stressful time. You want to find the perfect property in the perfect neighborhood while negotiating a great price, and you want to get all of this done before someone puts in a better offer. You also want to find the ideal down payment on a home. That’s hugely important. So, what’s next?

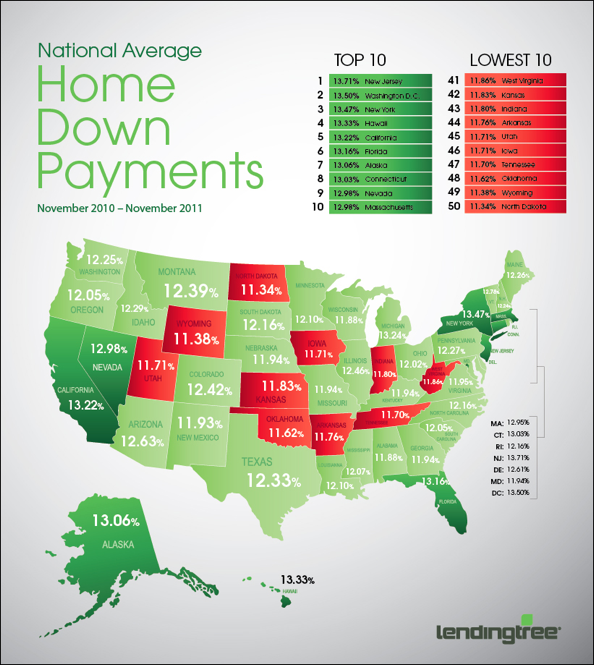

Once you have accomplished that, you still must obtain financing, and that opens a load of uncertainty. First time Minnesota homebuyers have a lot of questions, and one of their main worries is, “how much money do I need for a down payment?” Whether you are working with a realtor contract or looking for alternative financing like a contract for deed, this LendingTree chart is helpful as it shows state by state average required down payments:

Consistent

As you can see, average down payments fall into the 11 to 13 percent range. This doesn’t mean, however, that there aren’t alternatives. Actually, in today’s mortgage landscape, you can expect to pay somewhere between three and 20 percent of the sales price as a down payment. Government backed FHA loans do have that three percent first-time buyer down payment rate, and you can obtain some VA loans with no money down.

Higher Risk?

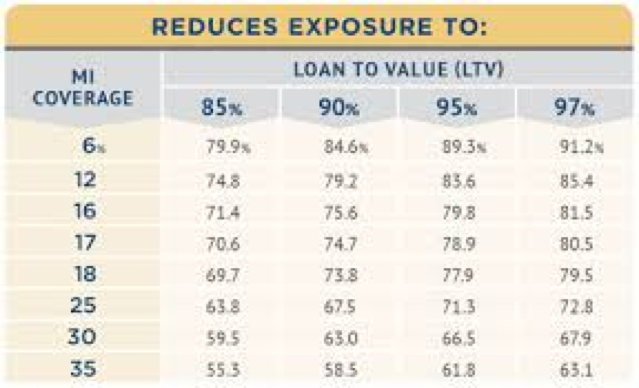

If your down payment is lower, your lender will perceive you as a higher risk, and the result may be a higher interest rate. Again, government programs including the Agriculture Department’s Rural Development Program can cut your rate, but generally, the less you put down, the higher your rate may be. Also, simple math tells us that the less you put down, the higher your mortgage loan balance will be, and that of course translates to higher monthly payments. Also, consider that for most loans with a less than 20 percent down payment, you may need private mortgage insurance or PMI. This can easily add $150 or more to your monthly payment.

Calculator.net is a great site that can help you figure out exactly what your monthly payment will be, as it walks you through taxes, PMI, homeowner’s insurance and other costs. There is even a place to enter other costs if you are, for example, buying a house with student loan debt.

Solutions

So, you’ve calculated that you need a $10,000 down payment to finance your home but are worried that it’s going to be difficult to save that amount. Here are some ideas:

- Use your IRA.

- Borrow from friends.

- Search for government down payment assistance.

- Ask your rich uncle for a gift.

- Sell stuff.

- Get rid of your car.

- Ask your boss for help.

Alternative Financing

Sometimes non-traditional financing can be attained with a lower down payment. Rent to own and contract for deed are two popular alternative financing vehicles.

Contract for deed mn is a popular non-traditional method used to purchase homes. Rocket Lawyer tells us,

“under a Contract for Deed, the buyer makes regular payments to the seller until the amount owed is paid in full or the buyer finds another means to pay off the balance. The seller retains legal title to the property until the balance is paid; the buyer gets legal title to the property once the final payment is made. If the buyer defaults on the payments, the seller can repossess the property. In some states, a seller who repossesses a property must reimburse the buyer for the fair value of improvements to the house, as well as a reasonable amount for rent.”

Again, those that choose a contract for deed transaction many times find that down payment requirements are more flexible than those of traditional financial institutions. At C4D, we can handle all facets of Minnesota contract for deed transactions; they may be worth checking out. And as always, never enter into any real estate contract without first consulting legal counsel.