Getting your first apartment, whether that’s a studio in Milwaukee, Wisconsin or a 2-bedroom place in Minneapolis, and moving out of your parents’ house is great, but when you get married and start a family, you’ll want your own home. If you have a great job and a stellar credit history, you might sail right through the loan process but what if you have terrible credit? Bad credit does happen to good people and here a few reasons why, if you are a first time home buyer with bad credit that you may be having difficulties getting loan approval:

- Divorce

- Job loss

- Over use of credit cards

- High student loan balances

- Judgments

- Liens

- Arrests

- Tax warrants

- Bankruptcy

Miss a payment here and there and your credit rating can take a huge hit, and if you have to declare bankruptcy, your credit score can instantly drop 100 – 150 points or more. If something bad has occurred, does that mean you can never buy a home? The simple answer is that no, you may be able to purchase a home, but it will take some work.

Check Your Scores

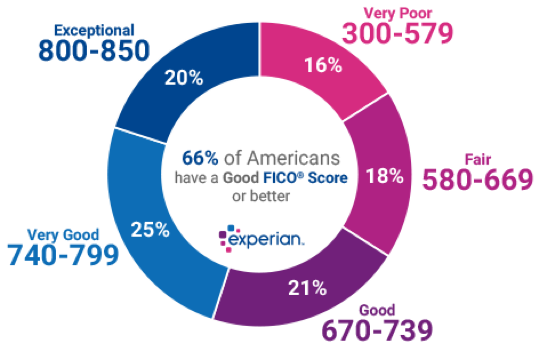

First, don’t enter the battle without ammunition. Make sure you know what your credit score is, and also examine your credit report for errors. The Federal Trade Commission reported that “One of every five American consumers has an error on his or her credit report and 5 percent of us endure errors so serious that we likely are being overcharged for credit card debts, auto loans, insurance policies and other financial obligations, according to a comprehensive study issued … by federal regulators.” A simple late payment error can take your score down by 30 points so if you see errors, dispute them.

Raise Your Limits

A large portion of your credit score consists of your credit usage ratio. If you have $10,000 in various credit lines and have balances that equal $4500, your usage rate will be 45 percent. Your credit score will be higher if you can keep the ratio below 33 percent. One easy way to lower that ratio without paying down your cards is to get a credit line increase. Increase your $10,000 lines to $15,000,you’re your $4500 usage will yield a 30 percent rate, and that will raise your score.

Trouble as a First Time Home Buyer with Bad Credit

If your score is still ugly, and you are having problems get approved for a loan, look to government programs. If you are a veteran, you can get a VA guaranteed loan for your first-time home purchase. This is a great way for a first-time homeowner with bad credit to get a loan even with a credit score in the mid-500s. FHA loans are another avenue to pursue if you have credit issues.

Contract for Deed

Many persons, however, just can’t qualify for conventional financing, and this is where a contract for deed might work for you. Find a reputable company like C4D. They will but the home you are interested in and then sell it to you with a MN contract for deed. You can live in the home, and after you have made all of your payments, you will own your home.

It sounds simple, and while you still have to qualify, companies like C4D look at more than your credit score. If you are a first-time home buyer with bad credit, check all of your options, but be sure to add contract for deed to the list.