If you are a member of a minority group, you may have a more difficult path to a minority home loan. If you don’t come from generational wealth, financing could be a huge problem.

Everyone faces obstacles when contemplating their first-time home purchase, but these difficulties can be more pronounced and harder to overcome if you are a minority home purchaser. Let’s look at the top five:

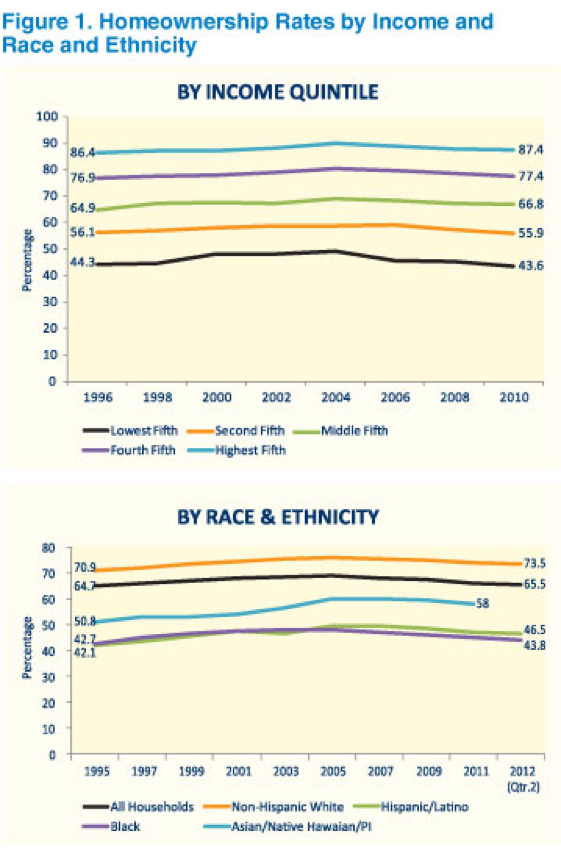

Insufficient Income for Minority Home Loan

The debt-to-income ratio calculation is a method used to determine whether a prospective applicant for a minority home loan can afford the purchase.

While this number varies, many lenders and government agencies use 43 percent as the figure. In other words, no more than 43 percent of your income can go toward your mortgage payment. Even if you have a great credit score, your income may be too low for your minority home loan.

If you’re struggling, you might want to look into some side hustles and learn about more passive income ideas.

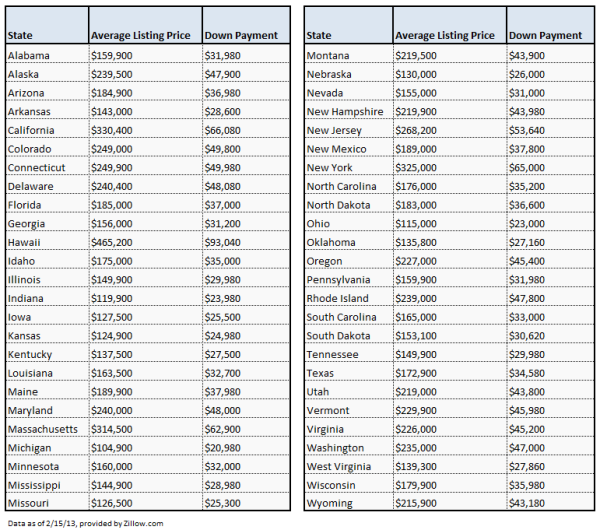

Down Payment Trouble

Image credit: zillow.com

You may have great credit, a steady job, and a promising future, but if you haven’t been able to save for a minority home loan down payment, you may have to access available aid sources. A gift from a relative, or loan from Minnesota Housing, a legitimate governmental agency are two places to look.

Access to Credit

Let’s face it, even in 2018 you may still encounter racial bias when applying for your minority home loan. Check out these North Carolina statistics from WUNC:

“For all 203,939 loan applications in North Carolina in 2015 and 2016, 52,881 were from minorities, and had an overall denial rate of 11.5 percent. 151,058 were from whites, and had an overall denial rate of 6.3 percent.

In 1,415 of North Carolina’s 2,117 Census Tracts where at least one loan application came from a person of color, the loan application denial rate was higher for minorities than for whites.”

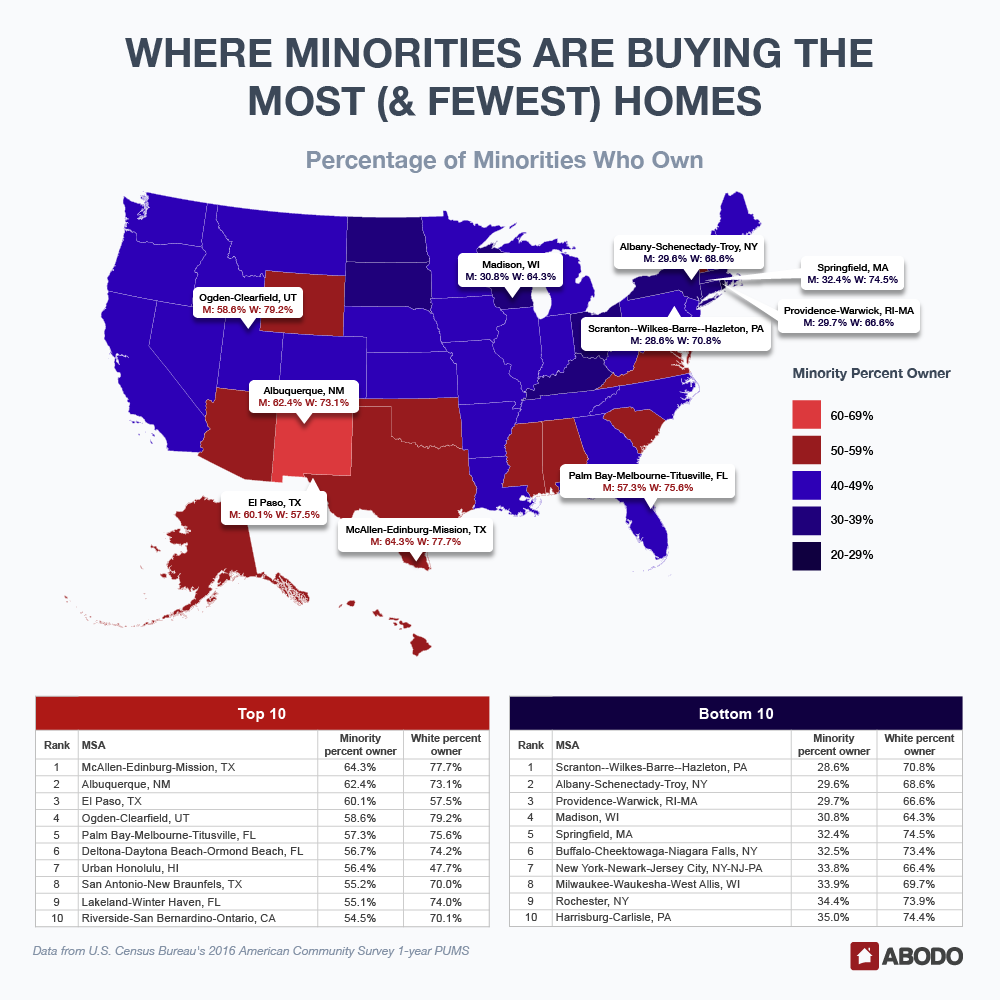

High Prices for Minority Home Loan

We mentioned the 43 percent debt to income ratio previously, and we know that since the 2009 recession, housing prices have dramatically increased.

If your debt-to-income ratio will only qualify you for a $150,000 home but there are none available in that price range, you can be out of luck. Higher home prices impact everyone, but while the wealthy can usually find a way to get their deals done, first-time minority homebuyers with good credit but low incomes can have a problem.

Just take a look at the graphic below from ABODO showing where minorities are buying the most and fewest homes. Interesting, huh?

Image credit: abodo.com

Minority Home Loan with Bad Credit?

Creditcards.com tells us that:

“Minorities are less likely to have access to credit than white Americans. (Recently), 20 percent of whites did not have access to a credit card compared with 47 percent of African-Americans and 30 percent of Latinos.

African-Americans and Latinos are less confident that they will be approved for credit than whites. In (recent years), 67.7 percent of whites were very confident or somewhat confident that they would be approved for credit, compared to 45.3 percent of African-Americans and 53.7 percent of Latinos. While 19.5 percent of whites were not confident that they would be approved for credit, 28 percent of African-Americans and 30.7 percent of Latinos were not confident.”

If you are a minority, the simple act of applying for credit may put you at a disadvantage. And earning money is tough, much like using the best survey sites to make a quick buck can take a while.

While minorities may face uphill battles on the path to home ownership, MN residents should look to contract for deed as a great alternative to traditional financing. If you need more information, contact us — an excellent place to start.