Contract For Deed: Homebuyer’s Guide

https://www.c4dcrew.com/wp-content/uploads/2017/12/MNHomeownership-1024x683.jpg 1024 683 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gThe Minnesota contract for deed process has been outlined succinctly below by the Greater Minnesota Housing Fund:

A contract for deed is an alternative financing agreement in which the seller finances the sale of the property rather than a lender. As with traditional forms of financing, the buyer takes possession of the home after the closing of the sale. When buying a home through a contract for deed, the home-buyer agrees to pay the seller the purchase price over time with interest in monthly installments.

Who Typically Utilizes the Minnesota Contract for Deed Option?

Minnesota Realtors report that a substantial number of consumers that have been turned down for conventional mortgages consider contract for deed financing. Many hard-working individuals face credit issues at times, and contract for deed homes in Minnesota can be a great way to overcome mortgage financing problems like:

- Bankruptcy

- New job

- Divorce

- Non-provable income

- 1099 income

- Small business income

- Gig economy income

- Barter income

Minnesota Contract For Deed: How It Actually Works

The contract for deed process is an installment sale. With a reasonable and sometimes smaller down payment, a home-buyer can purchase a home without the intense credit scrutiny normally experienced with traditional mortgage financing. The owner of the home is the seller, and that owner finances the sale. The buyer immediately takes possession of the property, but the deed remains with the seller until all payments have been made.

What Can Derail Conventional Mortgages?

Since the Great Recession of 2009, requirements to obtain conventional mortgage loans have been seriously tightened as anyone that has applied for a loan can readily attest. Any Minnesota Realtor can recite horror stories of good people with decent credit that were arbitrarily turned down at the bank. One even mentioned a client that had $1,000,000 in cash in the bank, had recently retired, had great credit, but was denied a loan because of a poor income to loan ratio! If millionaires can have problems obtaining financing, imagine the problems regular working home-buyers could face.

Minnesota Contract for Deed Advantages to Homebuyers

A great article by Alex Everest lists the following advantages to a contract for deed deal:

- You can now buy your home – an unfriendly bank will not be a problem.

- It’s easier to qualify – contract for deed sellers understand credit issues.

- No lender fees – those “junk” closing costs simply do not exist in contract for deed transactions.

- Quick closing – you can move as fast as you and the seller desire.

- Tax benefits – you are treated like the owner by taxing authorities.

- You can improve the property – you don’t need a landlord’s permission to remodel.

- You have a chance to rebuild credit – you can have your lender report your payments to the credit bureaus.

- You have the right to pre-pay – there are usually no pre-payment penalties.

- You will gain from property appreciation – you can build equity.

Possible Issues

- You don’t get title to the property until you have paid for it – you don’t “own” the home until you have paid for it in full.

- If you become delinquent, the foreclosure process can be quick – this process could take only 60 days.

- Your seller does not perform his/her obligations to his/her bank – the property may have an existing mortgage, and the seller, instead of using your payment to make his/hers, defaults on that mortgage.

- The property is encumbered – if you don’t do a title search you may be subject to mechanic’s liens, etc.

Your transaction has breached the seller’s “due on sale” mortgage clause.

We Are Different and We Can Help

We’re not going to lie to anyone that is looking for a Minnesota contract for deed, as we have seen significant instances of fraud and abuse. Sometimes an individual seller designs a contract with high monthly payments that is destined to fail . Unwary buyers can be saddled with a fixer-upper that has many more problems than anticipated. We have even witnessed predatory sellers that look for vulnerable and uneducated buyers in order to extract a few high payments; they eventually foreclose and then repeat the process. That is not what we do here, however.

Our Process

Normally, if you are interested in a contract for deed, a Minnesota Realtor will show you the homes listed with contract for deed financing as an option. What we do is different. If you find your dream home but cannot get conventional financing, C4D buys if for you. Then we own the home, we gain clear title to it, and we sell it to you. You get to pick the exact home you want.

Yes, of course we finance our purchase, but we accomplish that with our bank, and our bank requires no due on sale clause. They know exactly what we are doing, and in fact they protect you—the buyer–as a proper title search is completed. We are an established business and we make money by having deals succeed and culminate in your free and clear home ownership. We facilitate this process and do everything we can to ensure that the financing structure will work for you as well as for us. You are not dealing with an unknown sketchy owner you found on a home loans for bad credit site.

Apply Conventionally First

We encourage you to apply for conventional financing before you come to us. If that doesn’t work, however, inform your Minnesota Realtor that you are taking the deal to C4D. Of course you will have to fill out an application, and have a down payment—though in certain circumstances we can even help with that. Remember to assure your Realtor that we protect their commissions.

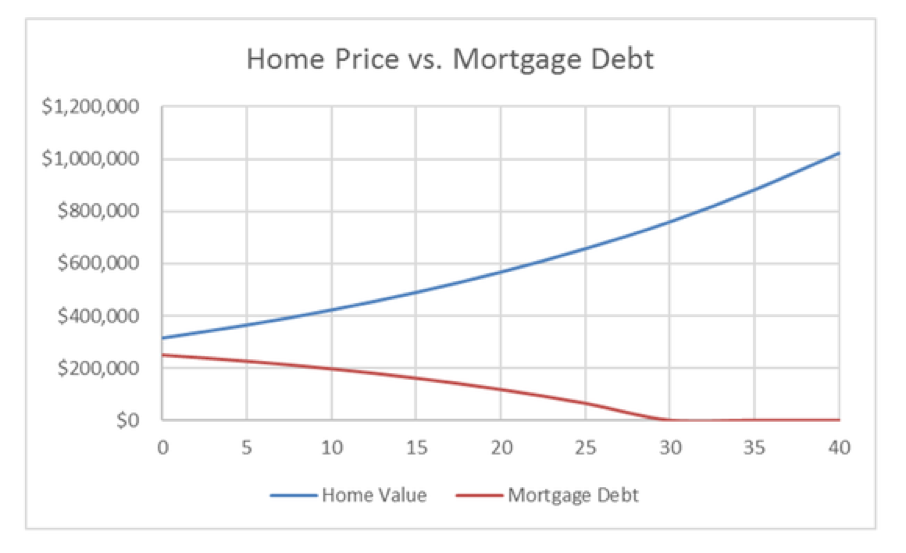

We’ll quickly analyze your situation; our goal is to work out a deal that benefits both parties and puts you on the path to home ownership. The Motley Fool gave us this great chart that shows what happens when you pay off your home instead of paying rent:

Image source: strawhomes.com

Image source: strawhomes.com

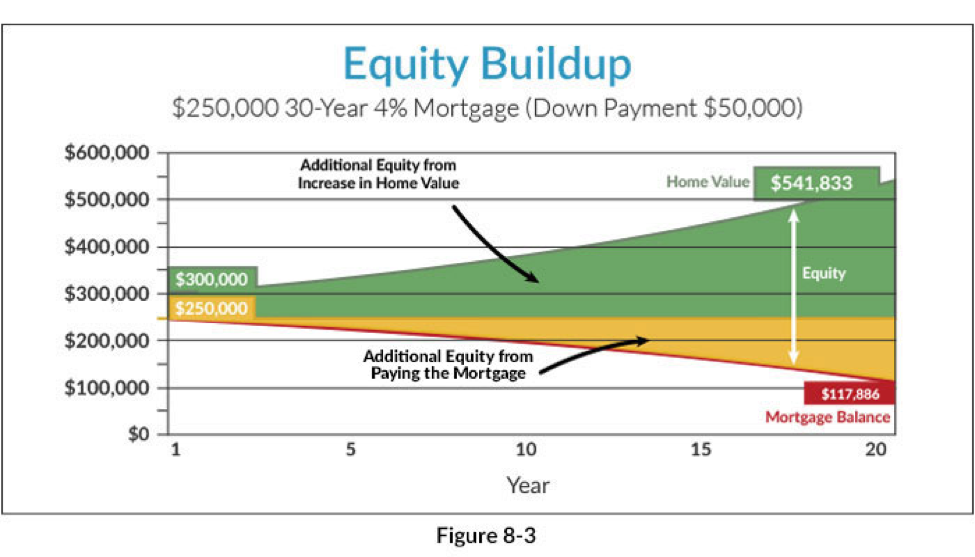

Here’s another one from Edelman Financial:

Start Now

If you’re renting, have had credit issues, and don’t want to wait for that ethereal day when the bank finally might say yes, contact C4D today. We will do everything we can to make home ownership a reality and not just your dream.

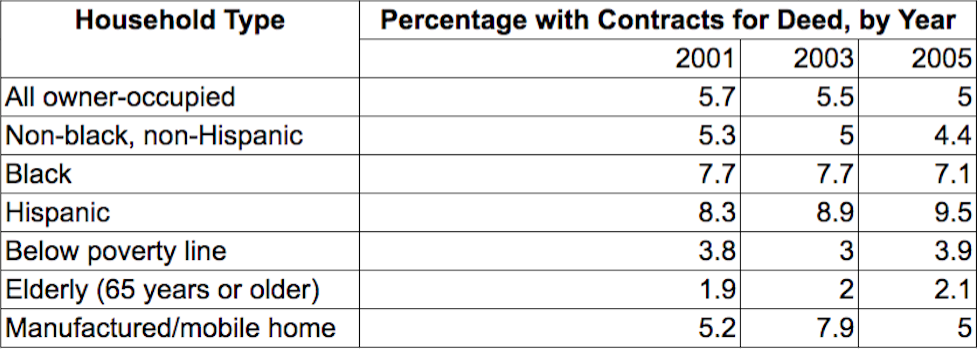

Source: American Housing Surveys 2001, 2003, 2005,

Source: American Housing Surveys 2001, 2003, 2005,