Buying After Foreclosure: Your Next Steps

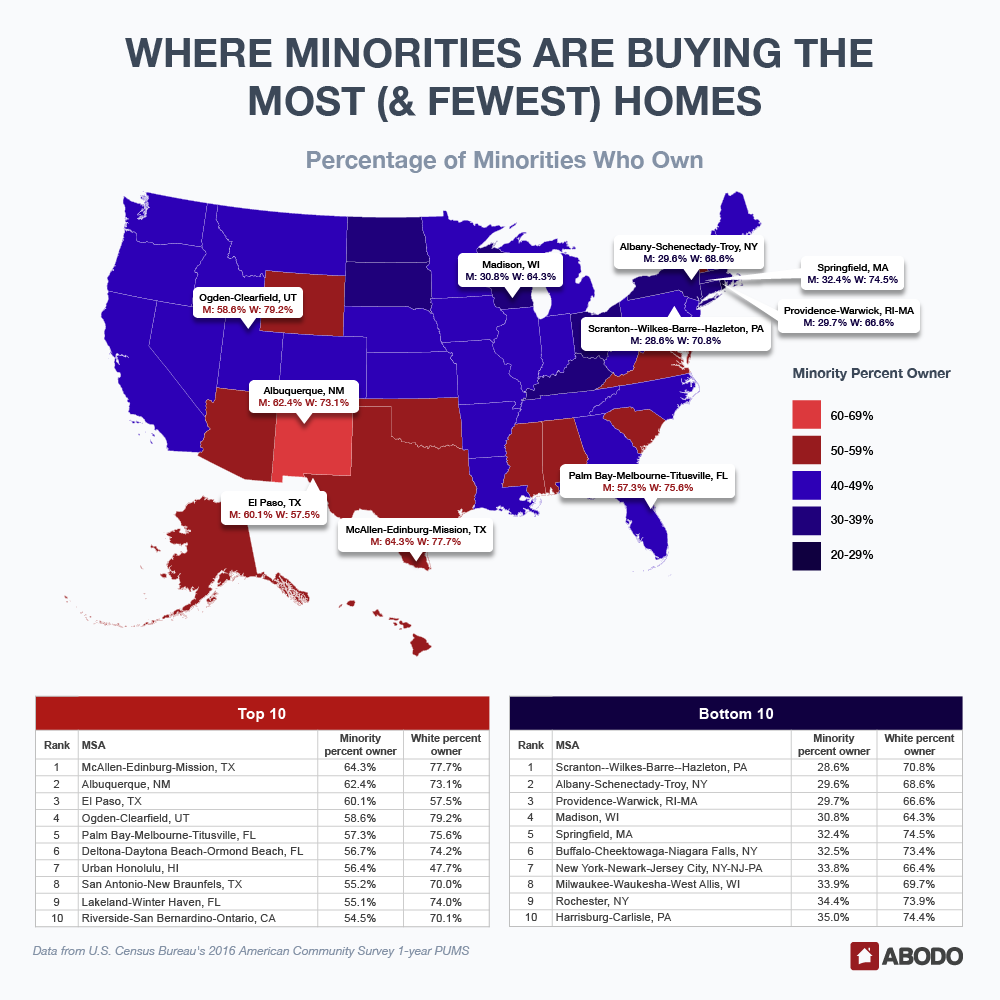

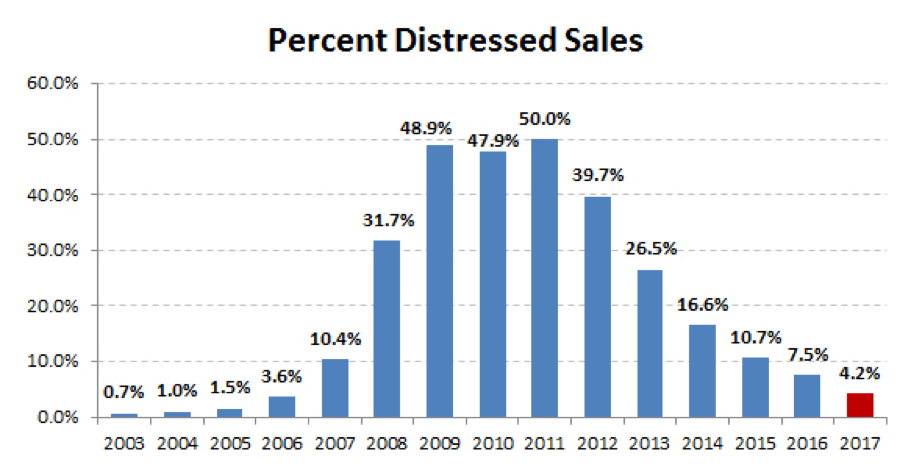

https://www.c4dcrew.com/wp-content/uploads/2018/04/CONTRACT-FOR-DEED_-PROS-AND-CONS-17.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gWhile many people think that foreclosure, like bankruptcy, signals financial death, this is simply not true. The chart below shows that distressed Minnesota home sales have significantly fallen, but if you lost your home to foreclosure, contrary to what you might have read, you may find yourself in the market for buying a house after foreclosure.

What Is Foreclosure?

Our friends at Investopedia define foreclosure like this:

Foreclosure is the legal process through which a lender seizes a property, evicts the homeowner and sells the home after a homeowner is unable to make full principal and interest payments on his or her mortgage, as stipulated in the mortgage contract.

Here’s why it might have happened to you.

Buying A House After Foreclosure: The Reasons

You may have faced foreclosure for one or a combination of the following reasons:

- Major illness

- Job loss

- Spousal death

- Predatory mortgage practices

- Adjustable rate loans

- Unexpected relocation

- Divorce

- Excessive credit card debt

- Lots of student loan debt

- MN Bad credit

Regardless of the cause, you can take steps now to first rebuild your credit, and subsequently find yourself buying a house after foreclosure.

Credit Repair

The first thing to do is repair your credit. If you have overwhelming debt and are continually making payments late, it will be difficult to make progress. It is important to become cash flow positive in order to begin chipping away at your debt, and a legitimate credit counselor or a good financial advisor can help you here. If you don’t feel that you will ever be able to get out from under your particular debt situation, bankruptcy may be an option since this would give you the proverbial clean slate to begin again.

Everything Has Its Price

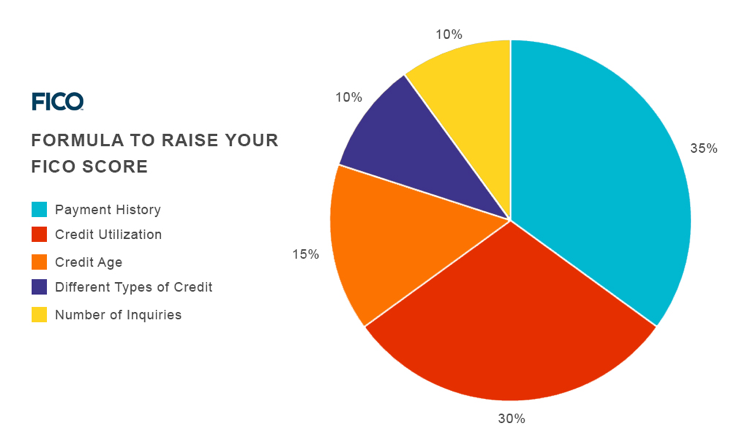

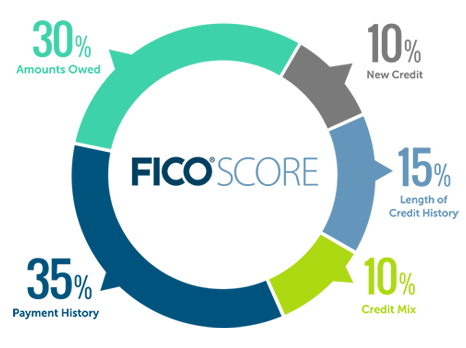

If you have gone through foreclosure, you already know that foreclosure will quickly drop your credit score – maybe 100 points or more. Bankruptcy can do the same thing, so there will be a time period when no one wants to lend you any money. You can rebuild your credit but it means being diligent and taking small steps. This FICO chart explains what categories constitute your credit score:

Get A Card

The first way to repair your MN bad credit is to get a credit card. This may have to be a secured card; in this situation you deposit money with the credit card company and basically borrow against it. You do this because if you make on-time payments, these will be reported to the credit bureaus, and your credit score will rise. Make sure you are never late on any payments, and that you do not make the same mistakes that got you into trouble the first time.

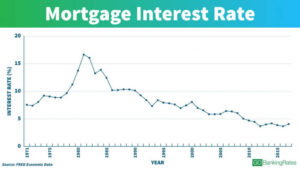

Time Is Your Friend

If three years have passed since your foreclosure and you have had stellar credit since that time, it will be possible for you to get a mortgage. You probably will have to come up with a 10 percent down payment, and lenders will be a lot happier if they see that you have saved that amount. Still, you will face a load of scrutiny, and you will pay a higher loan interest rate. You may be turned down by a number of lenders, and that can be a frustrating process. Keep in mind, you can find ways to make quick cash. For example, you could use the ibotta referral code to save a few bucks and get your finances in order.

Contract for Deed Financing

This is where your friends at C4D can help. We are a legitimate Minnesota business that helps people with bad credit issues, and we help them become homeowners. Our process looks like this:

- You find your dream home.

- You fill out our online application.

- We contact you.

- We determine if we can help.

- If so, we buy the home.

- Then we sell it to you utilizing a MN contract for deed.

Please feel free to contact us if you have any questions. Bankruptcy and/or foreclosure are traumatic financial events, but you can certainly recover from them, and we are here to help!

Image source:

Image source:

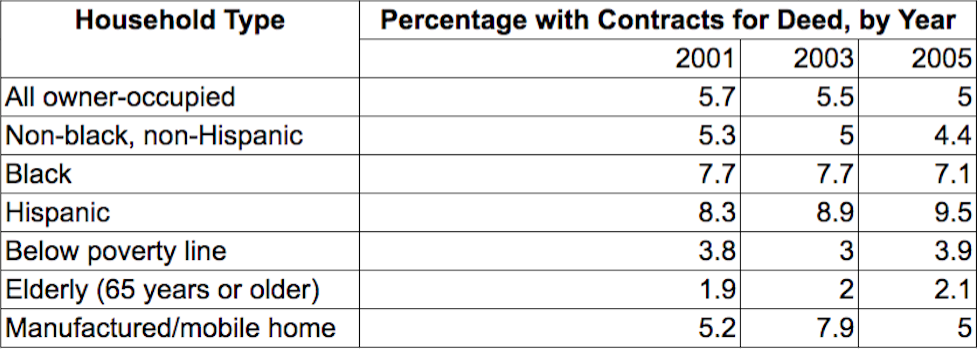

Source: American Housing Surveys 2001, 2003, 2005,

Source: American Housing Surveys 2001, 2003, 2005,