Rent to Own vs. Contract for Deed

https://www.c4dcrew.com/wp-content/uploads/2018/02/CONTRACT-FOR-DEED_-PROS-AND-CONS-7.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gSo you want to buy a house in Minnesota? You don’t want to do a rent to own deal or use some method of

“non-traditional financing.” In that case, it should be as easy as the steps below, right?

- Go to the bank

- Talk to a respectful and trusting loan officer

- Fill out some documents

- Prove income

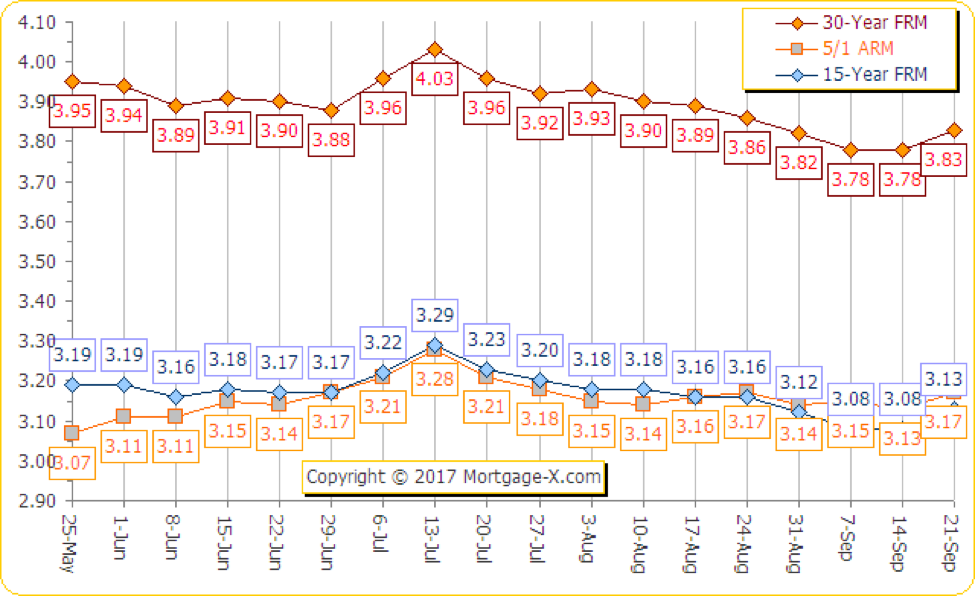

- Walk out with an approval for a $500,000 mortgage with low rates like the ones shown in this chart:

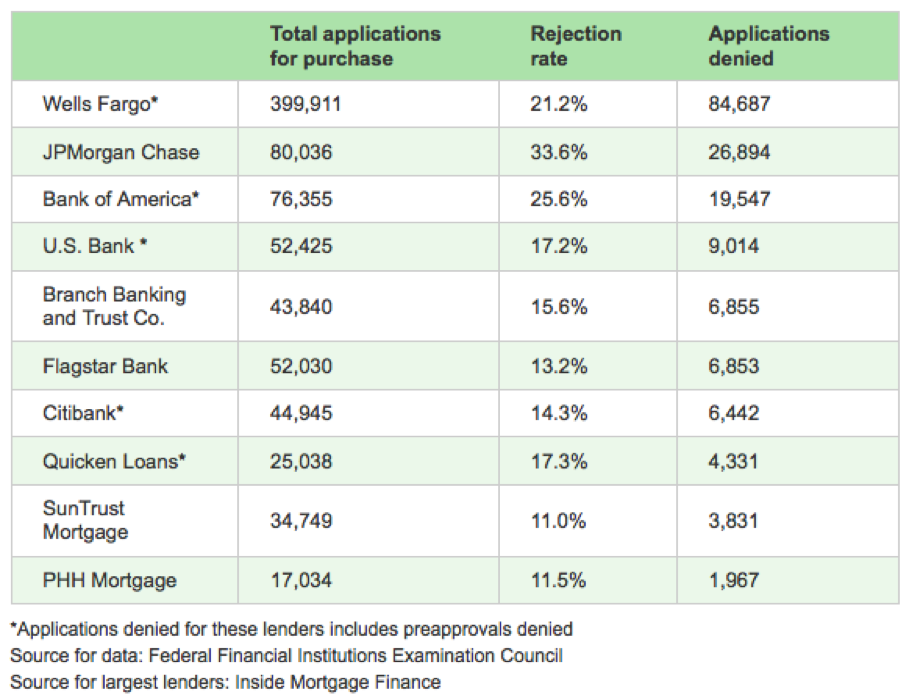

Unfortunately, however, that privilege is many times reserved for those with stellar credit, while others with the following issues may have to look elsewhere:

- Low credit score

- Judgments

- Garnishments

- Divorce

- Self-employment

- Tax liens

- Low debt/income ratio

- Job loss

- Unverified income

- High student loan balances

- Delinquent credit cards

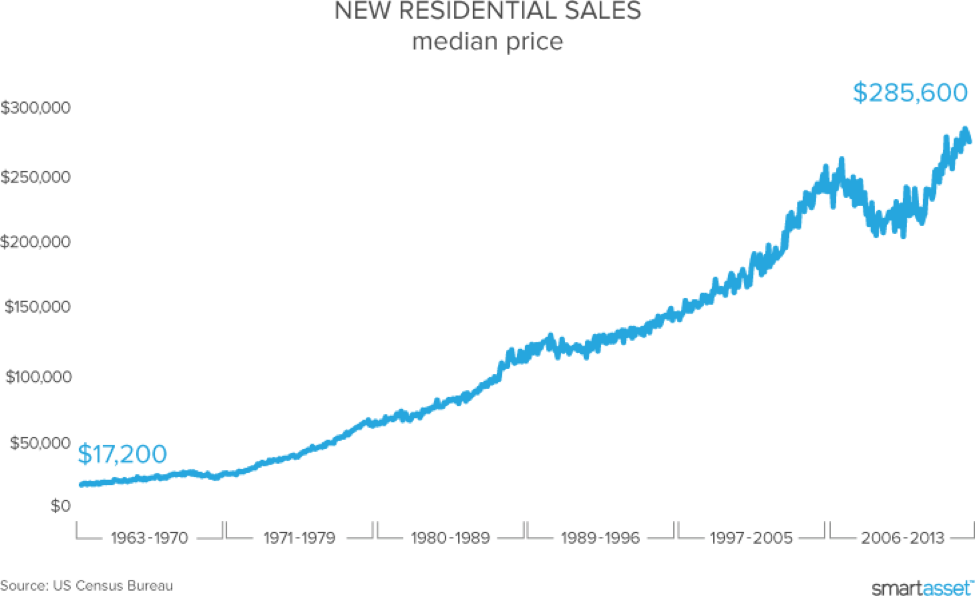

Luckily, there are alternative financing methods (since renting might not be your best option as Minneapolis rent prices are skyrocketing) like rent to own and contract for deed. With new residential sales still on the upswing as shown in the chart below, non-traditional mortgage products are very popular.

How Rent to Own Works

In a rent to own scenario, you first find your house, and if the owner agrees to enter into this type of non-traditional financing, you agree to a monthly rental amount, and pay a small up-front option fee that gives you the right to buy the home within a certain time period—usually no longer than three years. It is important to have a least a portion of your rent credited to the purchase price. So, if your rent is $1000 per month, for example, try to have at least $800 of your monthly payment applied to the purchase price of the house. Of course, the purchase price should be agreed upon ahead of time, and all of these components should be outlined in your Minnesota rent to own agreement.

The Advantages

- Your rent money is going toward equity.

- You have a fixed price for the eventual purchase.

- You aren’t responsible for property taxes, and possibly not for maintenance.

- You are locked in to more than a one-year lease.

- You don’t need to learn the items on a mortgage loan estimate (LE)

The Disadvantages

- You will have to find financing at the end of the lease term.

- You could lose your option money if you can’t obtain a loan.

- If you and the seller have over-estimated the home’s value, you could be underwater at the end of the rental term.

- The property could be encumbered by liens you aren’t aware of.

- If you don’t finish the deal your option money will be lost.

- If you miss a payment, the entire deal can be voided.

Contract for Deed

Many who seek alternative financing turn to MN contract for deed instead. With this process, you have an actual contract to purchase the property at a fixed price. As the Minnesota Federal Reserve has said,

“In a contract for deed sale, the buyer agrees to pay the purchase price of the property in monthly installments. The buyer immediately takes possession of the property, often paying little or nothing down, while the seller retains the legal title to the property until the contract is fulfilled.”

Minnesota is and has been a leader in the utilization of contract for deed instruments for those that need bad credit financing. The process is well-regulated and recognized by many as an efficient and reasonable home financing method for those with special credit situations. In contract for deed:

- Your payment is not rent–it goes toward the home purchase.

- You have no option money on the table to lose.

- Your contract term can be longer than a rent to own agreement.

- You have home financing at a fixed interest rate.

But Wait — Minnesota Is The Leader

If an unscrupulous owner sells a property that is already encumbered with liens, that can be a problem. In addition, if an owner files for bankruptcy during the contract for deed term, this can cause serious difficulties.

The Solution

A great way to avoid the pitfalls of both rent to own and Minnesota contract for deed is to deal with a reputable seller. While there are well-intentioned sellers in the contract for deed arena, companies like C4D take the process a step further as they are in the business of ensuring that the financing process is equitable, legal and fair. And, of course, never enter into any financing transaction without consulting with your attorney.