Rent vs. Own: The Actual Monetary Difference

https://www.c4dcrew.com/wp-content/uploads/2018/06/CONTRACT-FOR-DEED_-PROS-AND-CONS-25.png 1000 500 Sam Radbil Sam Radbil https://secure.gravatar.com/avatar/c8f81a032b93592f72744c525214f92a?s=96&d=mm&r=gSome consider rent vs. own to be the ultimate real estate question. For example, if you’re living in Dallas, should you just rent from a site like this because someone else is responsible for repairs, yard maintenance, storm damage, etc ., or should you take the plunge and become an owner so that you can build equity? Where is the tipping point? Where do the lines cross to indicate that it is more sensible to either rent or buy? Just because we are MN contract for deed specialists doesn’t mean that we blindly endorse one scenario over another, so let’s get started.

Let’s Take Autos as an Example

A CPA friend of ours used to buy all of his cars. He took care of them, nursed them along, and replaced countless brake pads, tires, alternators, exhaust pipes, and more. He had a rule that he would finally try to sell the car when the rear-view mirror fell off. Our friend would buy the cars with a bank loan and was obligated for four years of monthly payments. During the first three years, the car was under warranty, so major repairs were not a factor. The new car warranty usually ran out after 36 months, however, so in year four, our friend was making payments and paying for certain repairs. After year four the car payments ended, but repairs became more frequent.

Our friend would take the four years of payments, add repairs, then subtract that from the price he ultimately received for his used car. Frankly, with some vehicles he won, and with others he lost. Eventually our CPA decided that we would never buy a car again because it was a depreciating asset, and he didn’t want to own depreciating assets.

He instead decided to lease all of his vehicles for three years max. He made 36 monthly payments but any repairs were covered by the new car warranty. Many times, he could even get along without having to replace the tires. He considered the monthly payment to be a “cost of driving,” and figured that he would have had that cost anyway since it was either payments, payments plus repairs or repairs only. At the end, if he owned a vehicle, his $18,000 purchase might be worth only a few thousand dollars, and he decided that owning a car was a futile exercise.

But What About Homes?

Some people apply the rental theory to homes. They don’t want to cut the grass. They don’t want to pay for repairs, and they don’t want to worry about the housing market. If you agree, by all means find a great rental property and let someone else worry about the taxes, upkeep and maintenance. If something breaks, call the landlord and spend your money on something else.

Check Out the Residential Difference

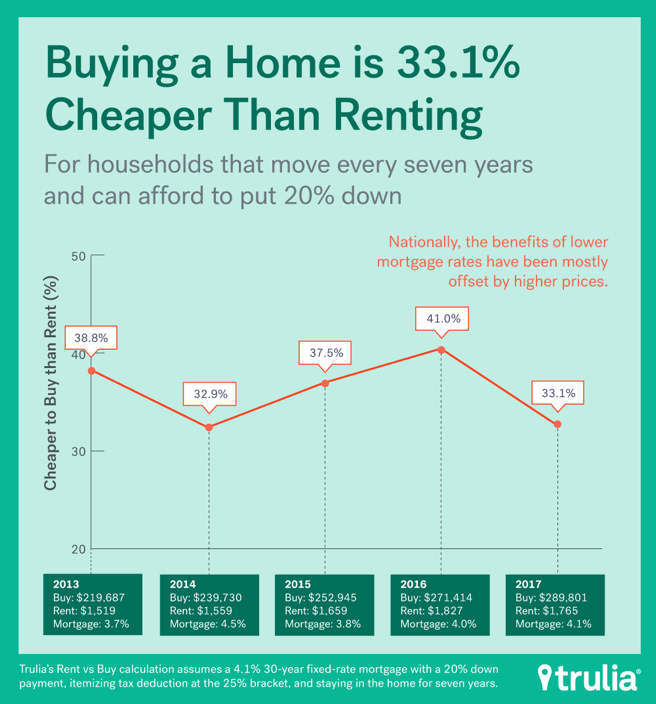

Image via Trulia

We do urge you to look at the other side, however, as there is a one huge difference: Homes increase in value. We of course can’t guarantee that every purchase is going to be a winner. But look at Austin, TX, for example where housing prices have increased over 30 percent in the last few years. And here is what Zillow currently reports about Minnesota:

The median home value in Minnesota is $225,300. Minnesota home values have gone up 8.0% over the past year and Zillow predicts they will rise 7.9% within the next year. The median list price per square foot in Minnesota is $177. The median price of homes currently listed in Minnesota is $265,000 while the median price of homes that sold is $237,300. The median rent price in Minnesota is $1,550.

Rent vs. Own: Compounding Benefits

When you buy, your monthly payment reduces the amount owed on your appreciating asset. You win both ways as your house becomes more valuable but you owe less. Your equity increases because you are paying down the loan, and because prices are rising. Furthermore, as you pay down your loan, the amount attributed to equity goes up, and the amount paid toward interest goes down. Get into that 10th ownership year and you may be surprised at the equity you have built, even if the housing market is not robust.

The Contract for Deed Crew Can Help

We can’t put money into your checking account (you can learn a ton of skills online to help you do that; example: how to start couponing). But remember, we can help you get a house. That said, we like traditional financing and congratulate you if you have been approved. If not, let’s talk about what C4D can do for you. We are MN contract for deed experts, and as we have told you previously, we many times say yes when your bank has said no. Go here for more info.