We all know that mortgages (there are many different types of mortgage loans) were the problem that caused the 2009 economic meltdown. Remember the movie The Big Short?

And while it was very difficult to obtain even the most basic and standard mortgages in the first few years following the crisis, things have begun to loosen up, and you now do have some different options.

The Standard Mortgage Loan

Your parents probably got a 30-year mortgage. That meant that the total amount of their loan was divided into 360 equal payments. The word “equal” can be deceiving, however, because the amount of interest v. principal collected for every payment varies. At the beginning of the loan, most of the payment goes toward interest, while the smaller remainder is applied to the principal.

Types of Mortgage Loans: An Example

With a $300,000 standard repayment 30-year mortgage at 5.25 percent, the payment amount would be $1657. In month one, $344 would go toward principal with a whopping $1313 applied to interest. By year 30 this changes drastically, and the last payment provides only $7 toward interest and the rest finishes off the principal. Note that this arrangement greatly benefits the bank, because during the first few years of the mortgage, most of the payment goes toward interest and you basically make no progress paying down the loan. This is why it is a good idea to make sure you are going to stay in a home at least for five years if your goal is to pay down the principal.

The 15-Year Mortgage

Years ago, 15-year mortgages were introduced. Our same $300,000 loan paid off in 180 equal payments over 15 years instead of 30 would cost $2412. Sure, that’s $755 per month more, but if you followed the 15-year amortization schedule you would not only have your home paid off in only 15 years instead of thirty, but you would save $135,900! If you could make the larger payment, the 15-year mortgage is the way to go.

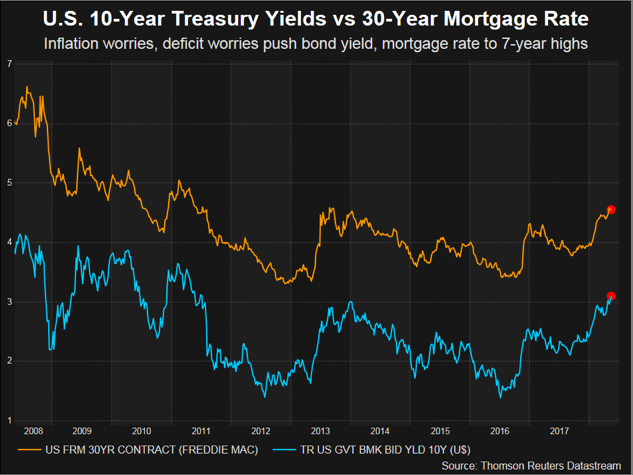

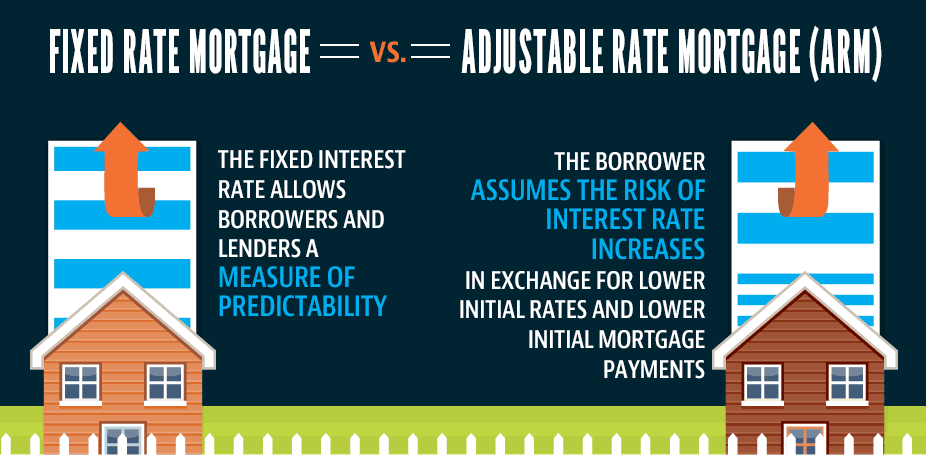

The Adjustable Rate Loan

These mortgages can be trouble, but they do have serve a purpose. Persons with lower credit scores can sometimes qualify for a mortgage with a floating rate. If general interest rates rise, so could your mortgage payment. If they fell, your payment could stay the same or actually decrease. The problem is, a two percent rise in interest rates would cause our $300,000 loan to rise to $2047 per month—a substantial increase.

Interest Only Mortgage Loan

While these loans can lower your monthly payment, you make absolutely no progress paying down your principal. These can work for flippable properties, but should be avoided for primary residence purchases.

Exotic loans like these are what caused the beginning of the last major housing crisis, and banks may not be very willing to make this kind of deal in the post-2008 era.

You Can’t Qualify?

Like we’ve said before, it would be great if everyone could go to a bank and get a traditional mortgage. Sometimes, however, because of credit issues, job loss, divorce, tax problems, or many other circumstances, the bank just says no. If this happens to you, don’t give up. We at C4D have developed a system where we use MN contract for deed to get you into a home. We deal with compromised credit every day, and we urge you to give us a call or email us before you just decide to keep renting. We’ve helped a lot of people!